Domestic consumption to support Q3 GDP

Economy

232 week ago — 5 min read

Philippine economy is seen to recover starting the third quarter but still not enough to reach the government target of 6.0 – 7.0% growth this year.

Growth is expected to clock in at 6.1% in third quarter and 6.4% in the fourth quarter, lower than the growth recorded for the same periods last year.

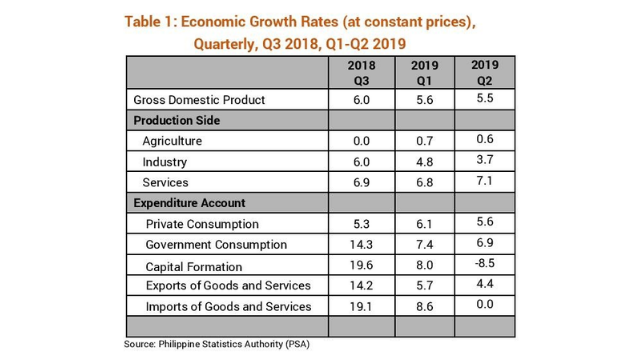

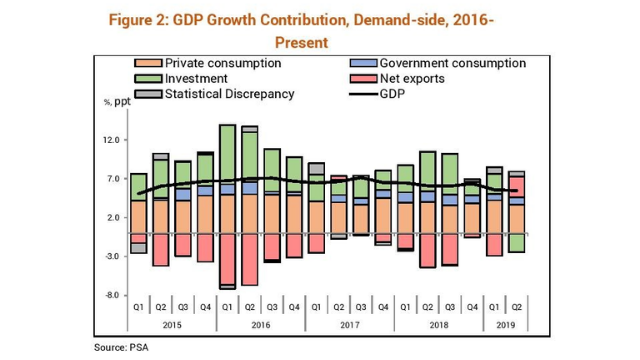

According to the Philippine Statistics Authority (PSA), government spending expanded only by 6.9% in 2019 of second quarter compared to 11.9% from 2018 Q2. Recall that it was only this April 15 that President Duterte has signed the 2019 budget into law. It cost the government about an estimated Php1 bn per day spending for the first quarter because of the late budget passage.

State spending accelerated in third quarter due to the government’s effort to catch-up with its expenditure. Expenditures jumped 39.0% to Php 415.1 bn in September, the fastest growth for this year. However, according to the Department of Budget and Management (DBM), end of August public infrastructure expenditures declined by 11.8% to Php 446 bn from Php 505.6 bn during the same period last year.

On the other hand, government revenues increased by 16.9% year-on-year to Php 236.5 bn from Php 202.4 bn due to higher imports and collections from the Tax Reform for Acceleration and Inclusion (TRAIN) Law, Rice Tariffication Law and National Food Authority tax expenditure collection.

Household spending likewise declined to 5.6% from 6.0% in the second quarter of 2018. However, consumer spending is likely to increase in the third quarter of 2019 due to inflation deceleration, low inflation rate, and higher OFW remittances which help boost consumption. The Q3 Consumer Expectation Survey showed that overall confidence index (CI) of 4.6% marked the best result since the fourth quarter of 2017.

Business Expectations Survey put the overall CI at 37.3% for the third quarter of 2019, lower than the 40.5% of second quarter though still better than the third quarter of 2018 at 30.1%. Investment remains to be a downside risk to the growth forecasts for the rest of the year.

Trade will remain a pulldown to growth as both exports and imports fall due to subdued investments in emerging markets coupled with persisting trade tensions.

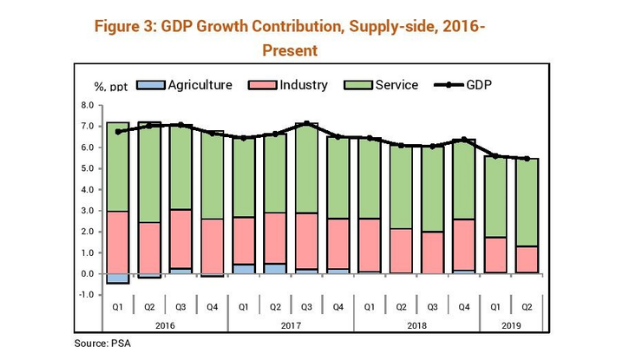

On the supply-side, industry declined to 3.7% in the second quarter of 2018 from 6.5% of 2018 in the same quarter. The Domestic manufacturing performance weakened in August largely due to the lower output of products. This marks the 8th consecutive month of declines for this year. Fast-tracking the implementation of the infrastructure programs might help the sector recover amid a less optimistic business outlook.

Agriculture, meanwhile, slightly grew at 0.6% in the second quarter of 2018 from 0.3% in 2018 of the same quarter. Growth in this sector still poses threat due to the delayed implementation of the supposed benefits from the tariffication law and the entry of African swine fever.

Services had the fastest growth at 7.1% coming from 6.7% in the same period last year. This sector will continue to drive growth fueled by the expanding financial services and tourism.

Economic growth is expected to have been driven by the robust remittances, improving employment, and benign inflation. Improvement in government spending is a critical growth driver. However, Economic Research Unit still thinks that it will be difficult to reach the set government target.

Article by Ruben Carlo Asuncion

Disclaimer: While this document is based on information obtained from sources we believe to be reliable, we do not make any representations as to its accuracy, completeness, correctness, timeliness or use for any particular purpose. Opinions and statements expressed here are those of their author(s) as of the date of this report and not of Union Bank of the Philippines (UBP). The opinions and statements provided in this document are subject to change without prior notice. Any recommendation contained in this document does not have regard to the reader’s particular investment objectives, financial situation and any other specific needs. This document is for informational purposes only and UBP is not soliciting any action based on it. Nothing here shall to any extent substitute for the independent investigations and the technical and business judgment of the reader. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this document or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Please login or Register to join the discussion