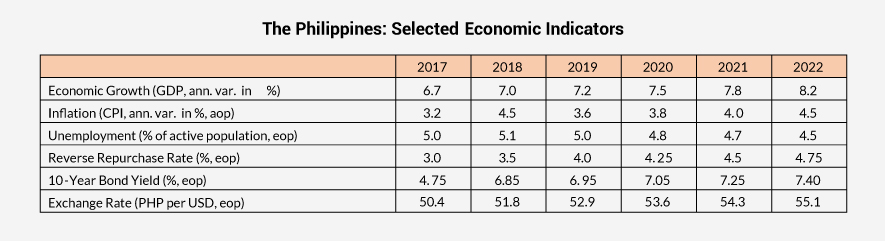

Economic outlook for the Philippines for Q1 2018

Economy

310 week ago — 6 min read

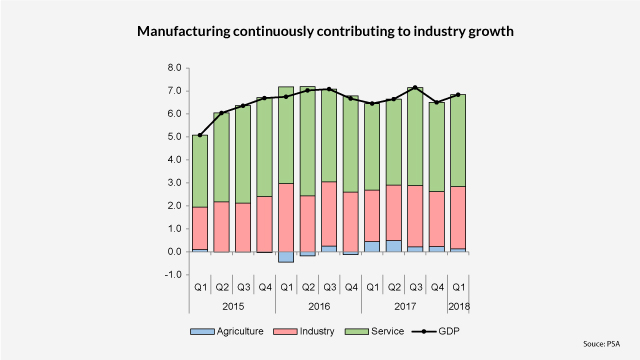

Philippine GDP growth at 6.8% in Q1 2018

Growth prospects for the Philippines remained strong as evident by the 6.8% growth in the first quarter of 2018 driven by strong investments from government and private sectors. This brings a seventy-seven (77) consecutive quarters of positive growth, starting Q1 1999. During the first quarter, the Philippines posted second among the fastest GDP growths in Asia, along with Vietnam (7.4%) and at par with China (6.8%).

Domestic Consumption to Grow Further

On the demand-side, investments fuelled the growth for Q1 2018. It grew 12.5% to PhP704.9 billion from PhP626.5 billion in the same period last year. Public spending ramp up even further at 13.6 percent with the continuous improvement in the ‘Build, Build, Build’ program. Infrastructure spending for Q1 2018 reached PhP157.1 billion for a 35% increases y-o-y. Improved public spending was also driven by high utilisation of cash allocation by government agencies at 98% in Q1 2018. Private consumer spending, on the other hand, increased to 5.6 percent in the first quarter with the implementation of the first package of the Tax Reform for Acceleration and Inclusion Act (TRAIN). Strong domestic consumption again has anchored Q1 economic growth with elevated inflation as the drag.

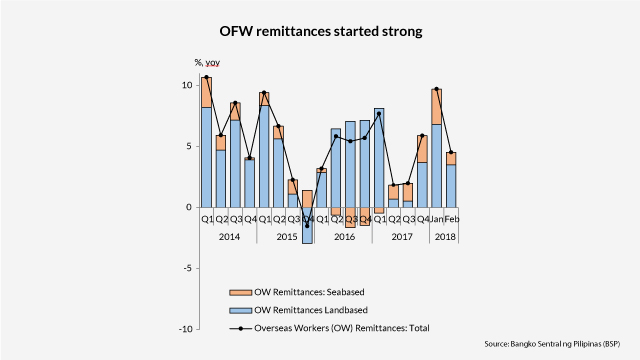

Remittances and IT-BPM Drive Growth

The Philippine economy continues a period of growth as the business process outsourcing (BPO) sector and remittances from overseas workers drive growth in consumer-oriented industries. According to BSP data, personal remittances from OFWs reached US$5.2 billion from Jan-Feb 2018, growing by 8.1% from a year ago. Growth was induced by rising domestic inflation and strengthening of the dollar.

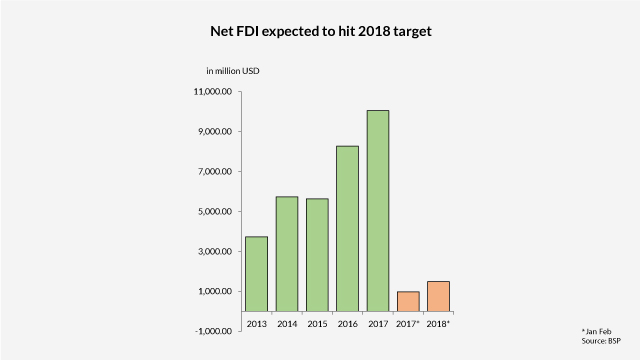

Increased FDI Inflow

Foreign direct investments (FDIs) net inflows reached US$1.5 billion in the first two months of 2018 up by 52.6 percent Jan-Feb 2017 amid the positive investor outlook on the Philippine economy. Capital placements came largely from Singapore, China, Hong Kong, Taiwan and Japan. These were invested manufacturing; financial and insurance; real estate; art, entertainment and recreation; and electricity, gas, steam and air- conditioning supply activities. Reinvestment of earnings reached US$130 million.

BOP to Remain Manageable

The country’s balance of payments (BOP) position posted a higher deficit of $1.23 billion in Q1 2018 from the $994 million gap in the same period last year. This could be attributed to the broadening merchandise deficit. The country’s total export sales amounted to $15.8 billion in Q1 2018, a decrease of 6.0 percent in Q1 2017. On the other hand, total imports amounted to $24.4 billion, 6.8 percent increase from the same period last year. This brought a wider trade deficit to $8.7 billion as demand increase for construction-related goods due to the government’s infrastructure push.

Industry’s Fast Growth

On the supply side, industry, through manufacturing and construction, pushed growth higher for the quarter. The services sector continues to be the main contributor to overall growth during Q1 2018. It grew by 7 percent in the first quarter. Industry growth grew faster and was broadly steady at 7.9 percent. Agricultural production eased to a 1.5-percent growth and will continue to post positive growth amidst weather risks. Manufacturing; Construction; Trade and Repair of Motor Vehicles, Motorcycles, Personal and Household Goods; Financial Intermediation; Real Estate; and, Transport, Storage & Communication were the main drivers of growth for the quarter.

Banking Industry Is Stable

The Philippine banking industry plays an important role in sustaining the growth of the economy. Total assets of the Philippine banking system (PBS) grew to P15.3 trillion as of end-Mar from P13.8 trillion in Mar 2017. Demand, savings and time deposits remain as the primary sources of funds for the banking system. Outstanding loans of the Philippine Universal and Commercial Banks U/KBs, gross of BSP reverse repurchase (RRP) agreements, grew by to P7.35 trillion in end-Mar from P6.32 trillion in the same period last year. Asset quality of the PBS remained stable with gross non-performing loans ratio at 1.82% as of end-Mar. The Philippine banking industry remain stable, based on the robust fundamentals of the system, and the country’s macroeconomic stability.

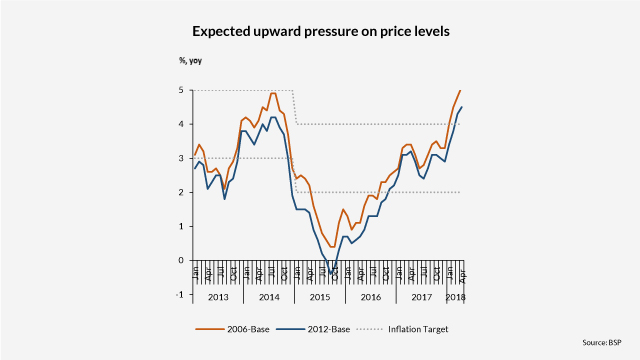

Downside Risks

Some of the risks for the year are the increasing inflation exceeding the government’s target, rising global oil prices, and weakening of the peso. Upward pressure on inflation or price level will continue to persist due to TRAIN law effects and other supply-side issues. However, this is seen as transitory and temporary due to the structural changes implemented through the TRAIN law. Also, the downward pressure on the peso is expected to continue as import demand increases due to increasing investments, both public and private ones.

Author: Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Please login or Register to join the discussion