Is your business holiday ready? These 5 practical tips will help you get prepared

Entrepreneurship

179 week ago — 7 min read

Holiday season is here! This marks the busiest season for most business owners.

The holiday season is a little bit different this year due to the COVID-19 pandemic; although, we are slowly getting back to business as usual and adjusting to the new normal.

Recently, the Department of Trade and Industry has issued a new memorandum circular that allows business establishments in areas placed under General Community Quarantine and Modified General Community Quarantine to operate at 75 percent and 100 percent capacity starting November 1.

However, you may still perhaps be recovering from the impact of the pandemic on your business. But don’t lose hope; there are still opportunities amidst the crisis. One is the fact that more people are now shopping online. Based on the study conducted by iPrice, the total sessions on shopping apps in the country has reached 4.9 billion.

How can you maximize these opportunities and prepare your business for this year’s holiday season? Here are some practical tips:

1. Optimize your online store

There is no doubt that digital is the new normal. Even if you’re not used to it, you should make e-commerce a priority.

Do you have your online store already? If yes, good for you! You are one step ahead in maximizing opportunities online. If you don’t have an e-store yet, worry no more; UnionBank GlobalLinker offers free online store for your business. Create your online store here.

Here are some practical ways to prepare your online store for the holiday:

- Ensure your online store is mobile-friendly. More people are using their mobile devices or tablets to shop online. It’s best to check and test whether your online store has a seamless process when buying online using mobile or tablet.

- Review your website load time. The ideal time for web page to load is three seconds. After that, you can lose your potential customers. If load time is a problem, review the content of your site and find out what’s causing the problem.

- Secure your online store. Ensure that your online store has SSL certificates to boost customer confidence and to protect your online store from fraudsters or hackers.

- Provide excellent customer support. Create automated response especially for frequently asked questions. Maintain a strong support system to guide your customers through the buying process so you can maximize conversions.

2. Go cashless

To minimize contact, ensure that your business has cashless payment options. This also saves time as you no longer need to count physical currency which may contain germs. It also reduces the risk of theft or money missing from cash register.

You can also maximize digital banking to save yourself from the hassle of going to physical branch of the bank and lineup. With UnionBank app, you can pay your bills and taxes online. You can also deposit a check by just taking a photo of it from their app.

If you’re looking for an SME-friendly business checking account, you can open a Biz Starter account with an opening maintaining balance of P5,000 only. You can apply here.

3. Keep innovating

Due to the financial impact of the pandemic, many people have been mindful of their spending, focusing only on buying essentials and daily needs.

This is why you need to innovate especially if you are selling non-essential products. For businesses in the tourism or fashion industry, you need to explore on developing new products that are essential at this moment.

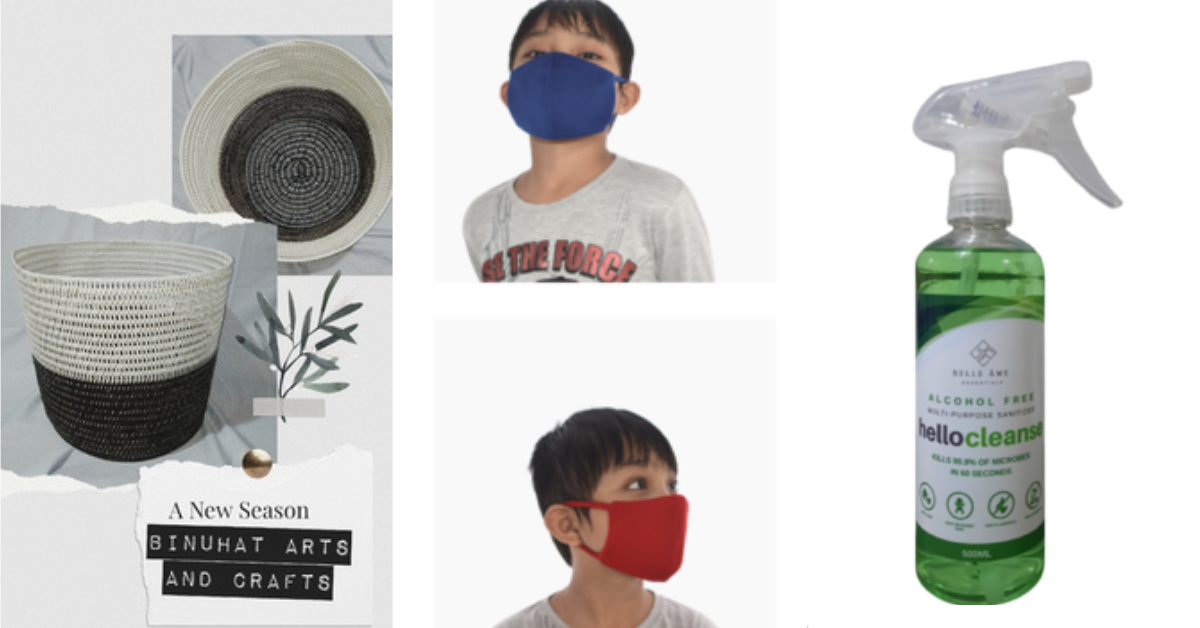

Here are some of SMEs that innovated their way to survive and thrive in the pandemic.

- Binuhat Arts and Crafts. They used to sell fashionable handmade bags made by women of Dinagat islands. Now, they have shifted their focus into selling handmade home essentials including storage organizers, food trays, flowers pots, and laundry baskets.

- Crissander Enterprises. They used to sell fashionable accessories; but now, they have also developed new products that are export ready like face masks.

- Belle Ame Essentials From selling customized perfumes, Belle Ame Essentials shifted to offering multi-purpose sanitizers.

4. Make your employees happy

Your customers shouldn’t be the only ones who are happy with your service, your employees should too! Show your appreciation for their hard work and for being with you in this challenging time. Make sure you give their 13th month pay in a timely manner!

Also read: Best short-term financing to pay the 13th month pay of your employees

For small business owners, it may be a little difficult to provide a holiday bonus. But there are other ways to express your gratitude to your employees. You can do the following:

- Extend flexible working hours

- Send handwritten notes

- Give a reasonably priced gift from a local business

- Offer extra day off

- Host a holiday lunch/dinner party, observing safety protocols

5. Prepare your inventory

Do you have enough stocks to meet the holiday demand? It’s ideal to stock up best-selling products. However, with the changing consumer behavior, you should also consider trying other strategies to guarantee all stocks will be sold.

For example, you can try offering pre-orders to have an overview of how many products you will need to produce.

However, what if orders are too overwhelming to handle and beyond the capacity of your cash flow?

Given the situation, you may consider getting a short-term loan to boost your working capital so you can stock up enough products to fulfill orders.

Boost your capital with a short-term loan

Your business may run out of working capital while meeting the demands during the holiday season. Certainly, it’s the last thing that you want to happen.

Availing a short-term loan can help boost your capital and help you set aside funds in case there are unforeseen circumstances in this holiday season.

SeekCap of UBX, a subsidiary of UnionBank, can help you boost your working capital in order to meet your business needs.

Why avail short-term loans through SeekCap:

- Loan application requires minimal documentation

- Get multiple offers from different lenders to fulfill your credit needs

- You get a response regarding your application within only hours of applying.

- Disbursement of loan is as fast as three banking days.

Their short-term loan comes with flexible terms (3-6 months term) and avails a loan amount as high as Php 300,000. The interest rate is at 2% per month or 24% per annum with zero processing fees.

These are just some of the practical ways to make your business more prepared for the holiday season. Don’t waste the opportunity to bounce back and make a profit! Remember, nothing beats preparation!

Image source: Freepik

View GlobalLinker 's profile

Most read this week

Trending

Comments

Please login or Register to join the discussion