Philippine Economic Outlook: Cautious but still optimistic about growth prospects

Economy

294 week ago — 3 min read

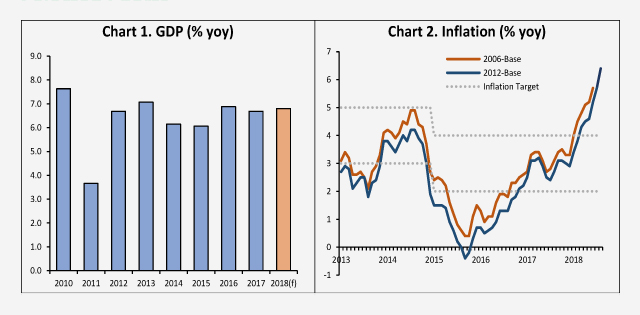

Despite a softer gross domestic product (GDP) at 6.0% in quarter 2 (Q2) 2018, the Philippines remains as one of the best-performing economies in Asia. The economy is still expected to achieve a full year growth of 6.5% (Chart 1).

Growth acceleration will be led by the expansion in manufacturing and services sector, and the increase in investment spending as the progress of infrastructure projects would benefit private and public construction.

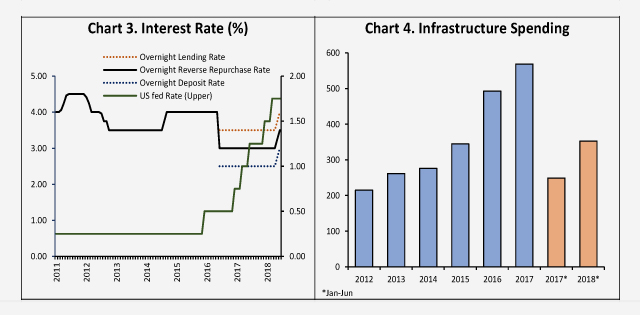

August inflation is at 6.4%, higher than 5.7% of July (Chart 2). Weight of supply-side price pressures from price increases in basic food products, higher electricity costs and gasoline prices are expected to push inflation to its peak by October. Higher core inflation levels indicate a higher September inflation print.

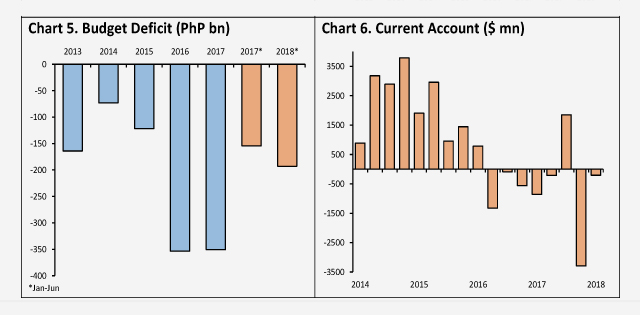

BSP is keeping the door open for more interest rate hikes. A 25 bps hike at its September 27th meeting to help manage expectations and another 25 bps increase by the end of the year (Chart 3).

According to the Department of Budget and Management (DBM), government spending on infrastructure grew as much as 41.6%, year-on-year in the first half. Spending on infrastructure development reached PhP352.7 billion up from PhP249.1 billion in the same period last year. The implementation of road infrastructure projects by the DPWH contributed to the increase (Chart 4).

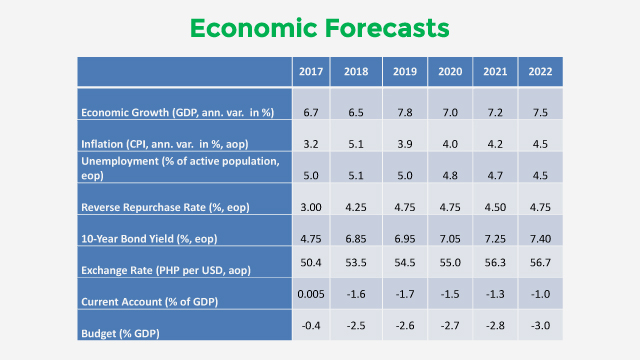

The National Government posted a budget deficit of PhP193 billion in the first half of 2018. This is higher than the PhP154.5 billion in the same period last year as the spending on goods and services outpaced the growth in TRAIN revenues (Chart 5).

The current account (CA) remains healthy, according to the Department of Finance (DoF), with the current account deficit declining in Q1 compared to last year. CA deficit declined to US$208 million from US$860 million from a year ago (Chart 6).

Looking ahead, we expect softer 2018 growth than current government targets with tighter monetary policy and an elevated inflation to persist for the rest of 2018. Despite these, the overall health of the macroeconomy is still robust and a stronger growth in H2 is expected.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its content.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

Most read this week

Trending

How this sister duo got greater business exposure and sales with an online store

Ecommerce 156 week ago

5 Must-Have Emails for Your Online Store

Ecommerce 34 week ago

Comments (1)

Please login or Register to join the discussion