UnionBank April 2018 Inflation Report

Economy

310 week ago — 3 min read

Inflation rose for basic goods and services in April 2018 as measured against April 2017. (Inflation is caused by an increase in demand for goods and services. When people want more of the goods, prices for those goods may increase.)

“Inflation for the next three months is not itself a basis for action… but if the forecast is that inflation will cover more commodities and will last longer, then that will call for a rethinking of the current policy stance,” Monetary Board Member Felipe M. Medalla said during the Development Budget Coordination Committee (DBCC) briefing last April 24th.

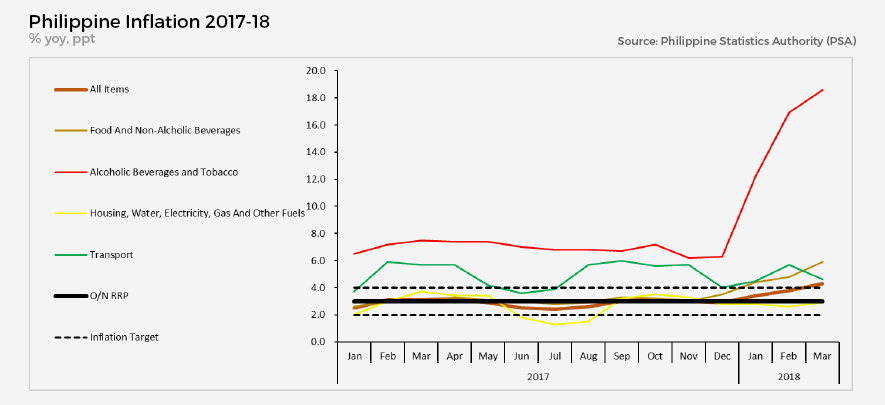

April inflation settled at 4.5%. Inflation last month was pegged at 4.3% and 3.2% in April 2017. The Philippine Statistics Authority (PSA) reported the following to have contributed to the recent rise:

- Alcoholic Beverages and Tobacco (20.0%)

- Transport (4.9%),

- Restaurant and Miscellaneous Goods and Services (3.4%)

- Alcoholic Beverages and Tobacco (20.0%)

- Transport (4.9%),

- Restaurant and Miscellaneous Goods and Services (3.4%)

These groups lead commodity groups with higher annual increments.

It is fitting to note that the annual inflation food index at the national level has eased to 5.5% from 5.7% of the previous month. The indices for meat, fish, oils and fats, fruits, and food products not elsewhere classified have been slower, while others have zero growth.

The Bangko Sentral ng Pilipinas (BSP) has considered inflation’s impact and whether it will continue to be broad-based (will cover more commodities). This latest level seems to be slower, month-on-month, and food indices seemed to have eased momentarily.

The huge question now is: Will the BSP finally pull the trigger this May 10th?

The BSP has recently mentioned it will not have second thoughts to undertake some decisive action. It is clear that the BSP has become more hawkish and has been more vocal about taking action. However, the conditions that will push them to act is not complete with the national food index recently easing.

Although inflation expectations are also higher, the Economic Research Unit (ERU) believes that the BSP has still ample room to stay and wait whether inflation is really unmanageable. At this point, there seem to be some easing. BSP may actually raise rates by June if inflation upward pressures persist.

Article by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

Most read this week

Comments (1)

Please login or Register to join the discussion