UnionBank August Inflation Report

Economy

294 week ago — 3 min read

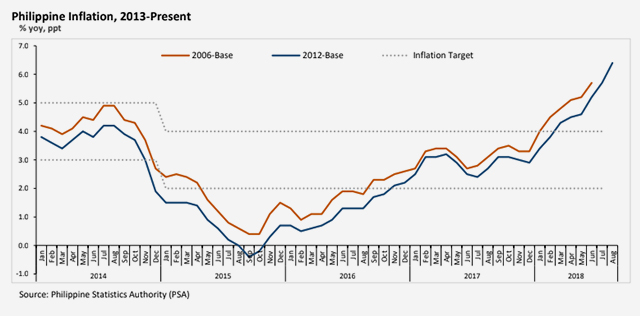

In August, inflation further accelerated to 6.4%, the highest in 9 years. Inflation last month was observed at 5.7% and 2.6% in the same period last year.

The main reason for the current uptrend comes from the biggest-weighted Food and Non-Alcoholic Beverages index with an 8.5% annual increase from 7.1% last month. All the food groups clocked higher increases in August compared with the previous month’s annual rates, except for corn.

The Food Alone index rose to 8.2% as compared to 6.8% in July and 3.1% in August 2017.

In August, inflation in the National Capital Region (NCR) was also higher at 7.0% as compared to 6.5% last month and 3.3% last year in August. For Areas Outside NCR (AONCR), inflation increased by 6.2% in August compared to 5.5% this July and 2.4% the same period last year. These point to a consistent uptrend in the level of prices all over the country. By region, Bicol has the highest inflation at 9.0% followed by the Autonomous Region in Muslim Mindanao (ARMM) at 8.1%. The lowest ones are the Cordillera Administrative Region (CAR) and Central Luzon with 4.1% and 3.6%, respectively.

Indeed, the July 2018 inflation print indicated that the worse is not over yet. Core inflation, a good measure of long-term inflation, was initially expected to be slowing down but seems to be going the opposite. 2018 year-to-date inflation is at 4.8% and August 2018 core inflation is also at the same level. This may mean that inflation has yet to see its peak, and we anticipate that inflation may soften starting October 2018.

With this surprise August 2018 inflation, the BSP is expected to raise rates on September 27. The Economic Research Unit (ERU) thinks that BSP will pull the trigger by 25 basis points and may follow through with another by December 2018.

ERU thinks that addressing the continuing high level of prices per se should be channelled and directed by tweaking general economic policies that can immediately cure certain market inefficiencies that are showing amidst the country’s economic expansion. More rice and other food products importation may address the short-term, but solutions with longer-term impact should be prioritized.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

Most read this week

Comments (1)

Please login or Register to join the discussion