UnionBank November Inflation Report

Economy

280 week ago — 4 min read

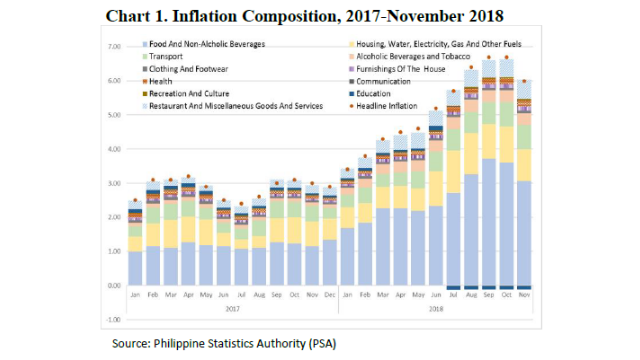

In November, inflation has eased to 6.0% with market consensus at 6.35%, according to Business World Survey.

One of the reasons for the decline is the slowdown in the annual increments of the biggest-weighted Food and Non-Alcoholic Beverages index with 8.0% compared to 9.4% last month due to slower price increases of corn, meat, fish, fruit, and vegetables.

In addition, Housing, Water, Electricity, Gas, and Other Fuels also declined from 4.8% in October to 4.2% last month. But transport inflation remains at 8.9% as the approved fare hikes for public utility jeepneys and buses were offset by the price rollbacks of domestic petroleum products.

However, higher annual increases were observed in the indices of the following commodity groups: Alcoholic beverages and tobacco, 21.8%; Clothing and footwear, 2.7%; Furnishing, Household Equipment and Routine Maintenance of the House, 4.0%; Health, 4.5%; Recreation and Culture, 3.2%; and, Restaurant and Miscellaneous Goods and Services, 4.5%.

Inflation in the National Capital Region (NCR) also declined to 5.6% from 6.1% in October 2018. For Areas Outside NCR (AONCR) inflation eased to 6.2% from October 2018.

Meanwhile, Bicol Region (Region V) still has the highest inflation at 8.9% in November. Despite this, its inflation was still lower compared to October’s 9.9%. The lowest was at 4.4% in Central Luzon Region (Region III).

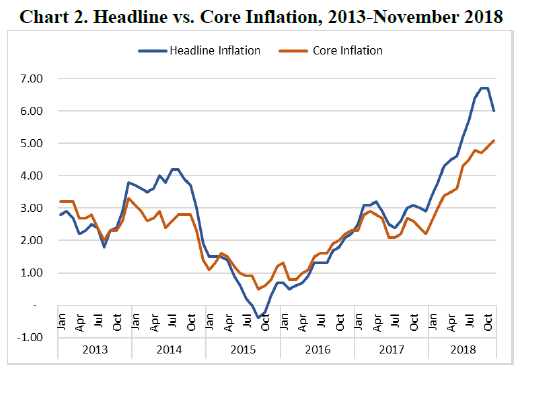

Furthermore, core inflation, a good measure of long-term inflation trend, was also higher at 5.1% in November than the 4.9% in October 2018 (See Chart 2). As headline inflation level slightly eased, the uptrend in core inflation may signal an upward pressure on price levels and that inflation may still be peaking. However, the steady decline of food-related indices may signal that inflation should still be closely monitored.

As the inflation continues to decline, the Bangko Sentral ng Pilipinas (BSP) has mentioned, through Governor Espenilla, that the October inflation numbers are “very encouraging” and it confirms that inflation is on track to return to the 2-4% target by 2019 despite the big miss this year.

As the inflation continues to decline, the Bangko Sentral ng Pilipinas (BSP) has mentioned, through Governor Espenilla, that the October inflation numbers are “very encouraging” and it confirms that inflation is on track to return to the 2-4% target by 2019 despite the big miss this year.

The BSP is expected to hold rates until Quarter 1 (Q1) 2019. With the lifting of the suspension of TRAIN’s second tranche fuel excise taxes set to be implemented January 2019, the BSP may opt for a 25 bps hike as a “pro-active” move against another possible run-up of price levels. However, this may be offset by the expected decline of global oil prices to pre-TRAIN numbers that altogether another probable “pro-active” move may not be necessary.

Thus, the UnionBank-Economic Research Unit (ERU) expects that inflation has already peaked in October 2018 and the deceleration will continue in the coming months. Inflation will probably return to the BSP’s inflation target next year between 2.0-4.0%. Note that ERU is projecting 2019 inflation at 3.9%.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in this Inflation Report does not constitute the opinion of UBP. Your use of this Report and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this Report or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Trending

Comments

Please login or Register to join the discussion