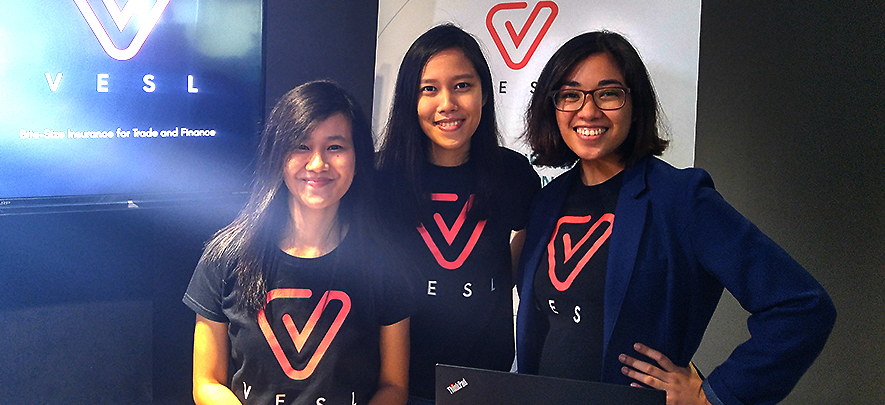

All women team provides better insurance options for small businesses

SME Inspirations

318 week ago — 5 min read

The website Trade Finance Analytics defines trade finance as something that ‘is used when financing is required by buyers and sellers to assist them with the trade cycle funding gap. Buyers and sellers also can also choose to use trade finance as a form of risk mitigation.’

Vesl is a trade finance company that provides a one of a kind insurance protection for trade invoices. This results in more flow of money in the small business owned sector which can benefit greatly from such an enabling entity when it comes to financing. Their mantra is to bridge a gap in the market; and they aim to help one million small business by 2025. Co-founders Maureen Ledesma, Jessica J. Manipon and Yroen Guaya Melgar drive their company on this mission.

Maureen explains, “So here’s what everyone needs to understand first: Trade credit insurance is more than just protection against a defaulting customer. Since it reduces a buyer’s credit risk, financial institutions are more willing to lend and even lower borrowing rates to insured transactions. Many businesses could benefit from trade credit insurance.”

In conversation with GlobalLinker (GL), Team Vesl shares their business journey. Watch the video to learn more:

GL: Tell us about your business.

Team Vesl: Vesl provides a one-of-a-kind insurance protection for trade invoices. Our platform offers affordable trade credit insurance, allowing businesses to purchase insurance per invoice. This allows more flexibility, rather than committing to an annual plan. Vesl then sends your insured invoices to its partner lenders for invoice or receivables financing.

This type of insurance has not always been affordable for small businesses, because existing insurers usually require an upfront payment of the premium for a whole year’s worth of turnover; and they will only entertain businesses with substantial turnover in millions of dollars.

The idea came into being when our CEO, Maureen, saw that many small businesses are unable to access trade financing. We viewed this as a big challenge and, at the same time, a big opportunity if we leverage on technology. There are existing FinTech solutions, but we believe that there is still more scope in the trade credit gap; and the solution may come from InsurTech.

GL: What are the challenges you have faced in establishing your business?

Team Vesl: Marketing an innovative insurance product to the market can be difficult. It is time consuming, and any startup needs to use an innovative marketing strategy to make its products sell.

Talent acquisition can also be a challenge. It’s hard to see a successful insurance talent willingly move across to join a startup. So we have to be careful in finding the right people to join our startup.

GL: What is the unique selling proposition of your business?

Team Vesl: Vesl’s unique selling proposition is pay per transaction trade credit insurance, covering invoices as low as USD 10,000 (PHP 500,000). Ours is the premier secure online platform worldwide that can distribute this product on a ‘per invoice’ basis.

GL: What are some of the milestones of your business?

Team Vesl: Some of our milestones our:

- Recognition from one of the most prestigious accelerators worldwide.

- Backed by institutional investors

- Gaining the confidence of the biggest insurer in trade credit, Euler Hermes; which is a subsidiary of Allianz

- Signed to collaborate with a regional bank in Asia

GL: What role do you feel GlobalLinker plays in connecting & assisting small businesses?

Team Vesl: UnionBank GlobalLinker is a one-stop shop for everything a small business owner needs to grow their business. From setting up your online store to finding suppliers and buyers, GlobalLinker is a good tool for small businesses that are looking for fast, convenient, and practical ways to make them stand out in this competitive market.

GL: What is your big business dream?

Team Vesl: Helping 1,000,000 small business across Asia by 2025!

GL: What is your message to aspiring entrepreneurs?

Team Vesl: Stealing the tag line from a popular Filipino reality show, our message to aspiring entrepreneurs is to “Dream, Believe, Survive”. Seriously, we think this is applicable even in building your own business. You just need to come from a good place within yourself upon making the conscious decision to be an entrepreneur. Believe in your idea, your teammates, and in your capacity to see through its growth till the end.

Network with Jessica Manipon by clicking on the 'Invite' button on her profile.

Disclaimer: This article is based solely on the inputs shared by the featured member. GlobalLinker does not necessarily endorse the views, opinions & facts stated by the member.

Posted by

GlobalLinker StaffWe are a team of experienced industry professionals committed to sharing our knowledge and skills with small & medium enterprises.

Network with SMEs mentioned in this article

View GlobalLinker 's profile

Most read this week

Trending

UnionBank GlobalLinker Linker.store Contest

Ecommerce 115 week ago

Comments (2)

Please login or Register to join the discussion