MktsFocUs: Bond steepeners likely with PSEI’s upswing?

Economy

248 week ago — 9 min read

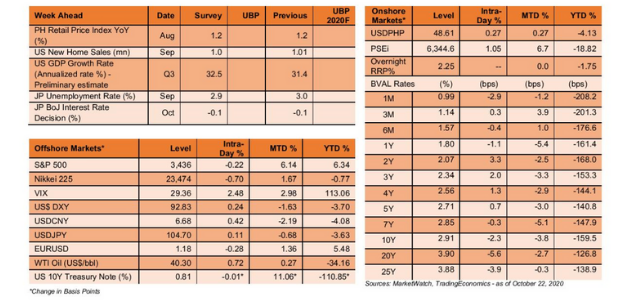

BVAL rates forecast ranges: 5yr: 2.691% - 2.865% 10yr 2.884% - 2.982%

pay short duration/Buy the 5yrs tenor at 3% if not more/Accumulate long end at 3.25% if not more

Week ahead (Oct 26-30): From last week’s auction results amid strong demand and liquidity, we sensed looming upside for duration yields starting with the belly of the curve. With muted threat of upside inflation risk, onshore liquidity may be taking its cue from offshore markets wherein liquidity has started its migration from a defensive portfolio headlined by US treasuries and into a cyclical risk-based portfolio. As markets price in a Democrat party sweep in the US elections, it insinuates a condition of strong fiscal stimulus/spending likely to boost next year’s US prospects. A 3Q US GDP print likely to offset 2Q losses (see Week Ahead) bolsters the case for firmer 2021 US prospects and sustained Treasury sell-off. By coincidence, the PSEi with its own set of catalysts tracked upbeat US equity markets. What’s missing onshore to complete the picture is a steeper local yield curve. Risk-reward ratio will not favor duration exposure if potential PSEi returns by end-year will exceed flat local bond yields.

Previous week’s recap (Oct 19-23): In Tuesday’s auction, BTr awarded in full its auction of the reissued FXTN 10-60 (4.9yr) that elicited a bid-cover ratio of 2.3x and fetched an average yield of 2.78% (High: 2.84%/Low: 2.68%). Treasury kept a lid on its tap facility following the auction. Despite this, local yields moved sideways although tilted to the upside spurred by some profit-taking and the 10yr US treasury yield edging higher past 0.8%

USDPHP forecast range: 48.40 – 48.70

Tactical sell USD/Long-term underweight PHP

Week ahead: Hard to ignore end-month corporate FX demand for imports that support re-stocking among industrial firms led by manufacturers while bracing for broader USD weakness as we near the US election. Easing foreign portfolio equity outflows in PHP positive. Investor sentiment improved as quarantine restrictions in the NCR eased further that facilitated business re-opening of tourism-service providers (e.g., hotels), lower curfew hours and less stringent foreign travel requirements. As we head for end-month week, USDPHP may trade in the 48.40-70 range but partial to the low end. Initial resistance expected at 48.69. Strong resistance at 49. Technical support seen at 48.50 and 48.28.

Previous week’s recap: USDPHP went through subdued trading and kept to within the tight range of 48.52-65. US election developments and US fiscal stimulus negotiations prior to the elections kept market participants distracted. Also awaited is broader week USD across the board on the back of a “blue wave” victory in the US elections.

PSEi forecast range: 6,000 – 6,400

Buy index on dips

Week ahead: 3Q earnings disclosures may compel scrutiny of sequential gains or losses relative to hefty 2Q declines that bore that brunt of the harsh lockdown in response to the COVID-19 outbreak late Mar-Apr. Sequential earnings improvement and low PER relative to next year’s earnings, will continue to drive PSEi’s upside. Market is seen consolidating above the 6,000 after last week’s breakout. This may give an opportunity for investors to re-enter the market and take positions in sync with 2021 economic recovery.

Previous week’s recap: PSEi outperformed regional ppers as the index breached upside of 6,000 early in the week. Buying momentum was sustained as net foreign selling dissipated for a 6.84% WoW gain in Thursday’s session. Market sentiment turned upbeat on news of government’s decision to further relax quarantine restrictions and open up the economy coincident with stabilizing caseload infections. Mining stocks were given a boost by the government’s announcement of resumption of oil exploration with China’s support, in the contested West Philippine Sea. 3Q corporate earnings releases started with BPI and URC that failed to dampen market’s mood.

Article by: Ruben Carlo Asuncion

Contribution from Bank Treasury, Trust & Investments and Corporate Planning Groups

Image Source: Freepik

No Warranties and No Liability

Basic information used in Market Narratives and MktsFocUs and other market/economic commentaries by senior staff of Union Bank of the Philippines (“UBP”) were sourced from news articles of several foreign and local broadsheets and news and market-based websites. As such, its contents are not owned by nor have been written or prepared by UBP. UBP does not own any of the contents of the Narratives, MktsFocUs and others and as such does not have any right to grant any rights to recipients. The terms and conditions of your use of the contents of the Narratives are governed by the rights granted and restrictions imposed by the source and/or owner of the contents and the same are subject to all applicable international and local laws and regulations.

Although the contents have been obtained from sources believed to be reliable, they are provided to you as presented, without any recommendations or warranties of any kind from UBP. UBP, its officers, directors, employees and agents cannot and do not make any representations and disclaim all warranties, express or implied, in respect of the Narratives and MktsFocUs and its contents, including, but not limited to, guarantees, representations and warranties regarding truth, adequacy, reasonableness, accuracy, timeliness, completeness, non-infringement, merchantability, satisfactory quality, or fitness for any particular purpose, or any representations or warranties arising from usage, custom or trade by operation of law. UBP, its, officers, directors, employees and agents assume no responsibility for the consequences of any errors, inaccuracies or omissions in the Narratives and MktsFocUs and other market-related publications.

Any opinion or statement in the Narratives, MktsFocUs, and other market publications does not constitute the opinion of UBP. Your use of the Narratives, MktFocUs and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on these market commentaries/research products.

The Narratives and MktsFocUs and related market commentaries are provided to you as a free service and on an “as is or as available” basis. As such, UBP does not guarantee the distribution of these research-based products will be regular, timely or uninterrupted. UBP, its officers, directors, employees and agents do not assume any responsibility for consequences of any non-delivery or non-provision, errors, delays, omissions, interruption, breach of security or corruption in connection with these market/research products, notwithstanding any prior advice of such possibilities.

UBP likewise does not guarantee, represent or warrant that the Narratives and MktsFocUs or any of its contents, including but not limited to links found in the contents, are free of malicious software, including, but not limited to, viruses, computer worms, spyware or other harmful components ("Malicious Software"). UBP, its officers, directors, employees, and agents do not accept any liability for any loss, damage, claim, liability, expense or costs arising or that may result from any transmission of such Malicious Software through these market /research products including, but not limited to files downloaded from the Narratives and MktsFocUs or from the compiling, interpreting, editing, reporting or delivering these bank research products.

In no event shall UBP be liable to you or to anyone else for any claim arising out of or relating to the Narratives and MktsFocUs, including but not limited to direct, consequential, special, incidental, punitive or indirect damages, even if advised of the possibility of such damages. UnionBank of the Philippines is supervised by the Bangko Sentral ng Pilipinas

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Trending

What is the Curse of Knowledge? How Does it Impact Communication?

Learning & Development 22 week ago

Learning & Development 60 week ago

Comments

Share this content

Please login or Register to join the discussion