2020 Outlook: Double budget growth impact

Economy

261 week ago — 6 min read

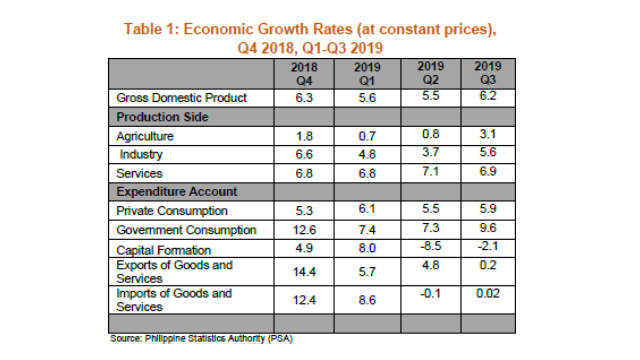

After three quarters, 2019 Philippine GDP growth averaged 5.8% with the Duterte economic management team aiming for at least 6.7% growth for the fourth quarter to exactly hit the lower end of the target 6.0-7.0% economic expansion for the year. Economic growth, so far this year, has been led by an industry sector recovery and the continued strength of the services sector. Agriculture, with meager growth in H1, has significantly recovered in the third quarter (See Table 1).

Private consumption has slightly recovered in the third quarter and is strongly believed to be growing further in the fourth quarter as domestic demand rises mainly because of the usual uptick of seasonal spending. The delayed 2019 national budget has clearly been the primary cause of the slowdown in government consumption in much of H1 2019. A slightly significant uptick in third quarter as the government is believed to be gaining needed traction for its spending catch-up plan was touted by economic managers after the 2019 budget was signed in April. Eventually, capital formation or investments in the economy took a big hit registering huge negative growth in second quarter and third quarter (See Table 1). UnionBank’s Economic Research Unit (ERU) believes that capital formation can pick up in Q4 as the budget spending continues to catch-up. Trade will continue to be sluggish as the fickle nature of the US-China trade negotiations continue its state of flux. The recent October data confirm the continued weakness of external demand where exports were flat and imports were shown to be declining in its fastest clip in seven-and-a-half years.

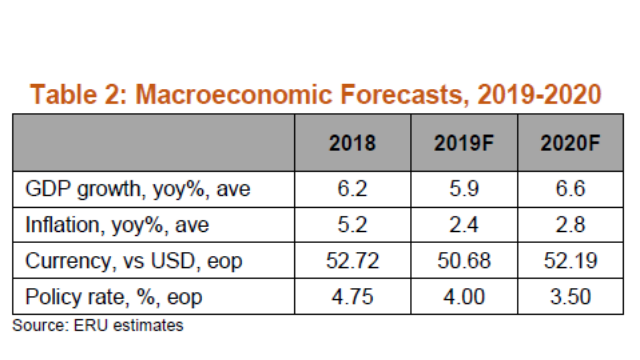

ERU’s NowcastingPH, a GDP nowcast model, puts fourth quarter GDP growth range between 6.1%-7.2%. However, ERU thinks that fourth quarter GDP growth may settle at 6.4%, putting full-year 2019 GDP growth at 5.9%. This is supported by signals from the seven-year-low October imports and historically weak absorptive capacity of government agencies involved in infrastructure projects implementation including local government units (LGUs). It is important to note, however, that both fourth quarter and full-year 2019 GDP growth forecasts are considered respectable and generally higher among its peers considering the sluggish global economic environment throughout the year.

With the extension of the validity of the 2019 national budget and the almost-there legislation of the 2020 budget of PhP4.1 trillion, 2020 GDP growth is expected at 6.6%. This sort-of “dual stimulus” may act as double insulation from the continuing and anticipated global economic and trade growth uncertainties. The BSP is expected to continue its expansionary monetary policy into 2020 with at most 50 bps more, as the central bank continues to unwind the 175 bps it raised back in 2018. This had major impact on the level of liquidity and domestic credit growth, consequently restraining 2019 economic growth.

ERU believes that inflation in 2020 will continue to be benign with the seemingly lack of supply coordination among OPEC members. Thus, global oil prices, a major driver of domestic price levels, are anticipated to be stable for 2020. However, a potential downside risk is a supply shock due to geo-political issues, ala Saudi Aramco attack last September. ERU is not ruling this out because of the Philippine economy’s dependence on imported oil.

Another downside risk to the 2020 outlook for the Philippines is the probable outcome of the US-China trade talks, whether there will be a partial or phase 1 trade deal and whether the upcoming additional tariff deadline (December 15) will push through or will be extended to accommodate more time to negotiate the said phase 1 agreement. The China-economic-slowdown risk incidentally hinges on the future of this trade deal with the US. China’s recent export numbers show the impact so far as the country’s export performance declined 1.1% unexpectedly in November and 23.0% lower trade into the US.

Another downside risk is the anticipated pick-up in Philippine import performance as infrastructure spending resumes full-swing and more next year. The 2020 current account is expected to be wider than expected, and may continue to weaken the peso throughout 2020. ERU thinks the peso will depreciate further to PhP52.19 in 2020.

Article by: Ruben Carlo Asuncion

Disclaimer:

While this document is based on information obtained from sources we believe to be reliable, we do not make any representations as to its accuracy, completeness, correctness, timeliness or use for any particular purpose. Opinions and statements expressed here are those of their author(s) as of the date of this report and not of Union Bank of the Philippines (UBP). The opinions and statements provided in this document are subject to change without prior notice. Any recommendation contained in this document does not have regard to the reader’s particular investment objectives, financial situation and any other specific needs. This document is for informational purposes only and UBP is not soliciting any action based on it. Nothing here shall to any extent substitute for the independent investigations and the technical and business judgment of the reader. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this document or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Most read this week

Comments

Please login or Register to join the discussion