Philippine economy strong; but tough measures needed

Economy

358 week ago — 3 min read

The Philippines has been recently assessed by the International Monetary Fund (IMF). In its newest Article IV Mission statement, IMF sees real GDP expanding to 6.7% in 2018 and 2019. Economics Research Unit (ERU) sees growth at 6.8% for 2018 and 7.0% for 2019. (See Chart 1)

July 2018 inflation is expected at 5.5%. Volatile global oil prices, the weakening peso, probable second-round effects of the tax reform, and other domestic demand pressures may have driven inflation higher. (See Chart 2)

Inflationary pressures are to continue to rise based on probable due to second-round effects.

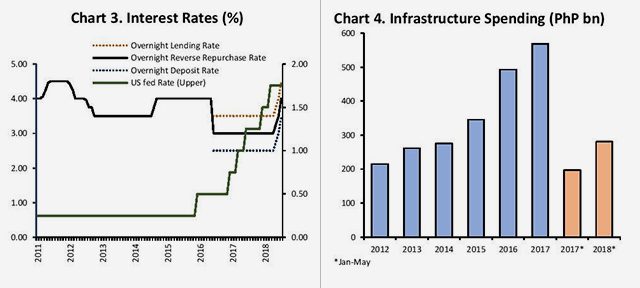

In line with these inflationary expectations, the BSP has signaled a “strong follow-through monetary adjustment” to help rein in the mentioned inflationary pressures. It is expected on August 9th that the BSP will suggest to the Monetary Board a 50 basis points hike as a “strong” response to the heightened inflation. (See Chart 3)

Initially, the UBP Economics Research Unit (ERU) expected two (2) separate monetary tweaks throughout 2018 but it seems that the BSP is serious about securing inflation expectations.

With 2nd quarter GDP growth rate due this August, the expected 7.0% growth is mainly from growing government consumption and investment. The Department of Budget and Management (DBM) cited that government spending on infrastructure grew as much as 26%, year-on-year.

Spending on infrastructure development reached PhP58.1 billion last May up from PhP46.2 billion a year earlier. This development is in line with the expectation that infrastructure spending and development will support economic growth in the medium-term. (See Chart 4)

There has been a boost in domestic consumption and private investment as well. The steady growth of OFW remittances in the first five months of 2018 feeds into domestic demand uptick together with the impact of the tax cuts through TRAIN package 1.

Services growth last Q1 2018 is expected to continue in Q2 2018, while a strong Manufacturing sector growth is projected to be healthy as well. (See Chart 5) Strong FDI inflows in Q1 2018 suggests that foreign investor sentiment continuous to be steady and strong. (See Chart 5)

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its content.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

SME Inspirations

Most read this week

Trending

Comments (1)

Share this content

Please login or Register to join the discussion