Do monetary policy rate hikes have an impact?

Economy

324 week ago — 2 min read

To deal with rising consumer prices, the Monetary Board of Bangko Sentral ng Pilipinas (BSP) hiked a total of 175 basis point from May to November 2018. These hikes brought benchmark interest rates from 4.25-5.25% range, the rate at 4.25% is the highest in nearly ten years.

What has been the impact of these numerous hikes?

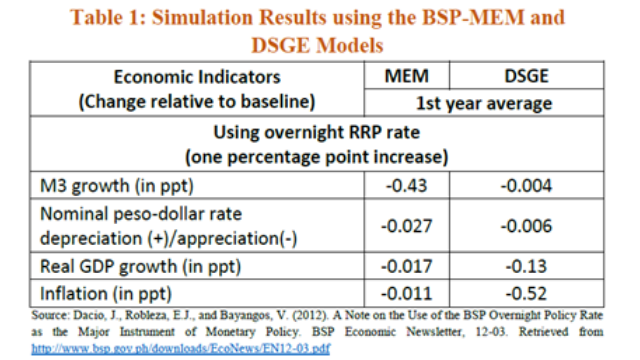

According to a 2012 research note, the BSP has simulated the impact of monetary policy using two models – the BSP’s Multi-Equation Model (MEM) and Dynamic Stochastic General Equilibrium Model (DSGE). Both models are meant to simulate the impact of monetary policy rate hikes in an economic system through particular variables. In this case (as shown in the table above), its liquidity (M3 growth), exchange rate (Nominal peso-dollar rate), economic growth (Real GDP growth), and inflation. For a full one percentage point increase (100 basis points), the impact on inflation is a decline of 0.52%, while real GDP growth decreases by 0.13% using DSGE. The MEM, on the other hand, describes liquidity decline of 0.43% and exchange rate to appreciate by 0.027%. Both simulations may describe a very substantial impact for the said variables at 175 basis points.

Economic Research by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in this report does not constitute the opinion of UBP. Your use of this report and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the MS or any of its contents

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion