UnionBank May 2018 Inflation Report

Economy

368 week ago — 3 min read

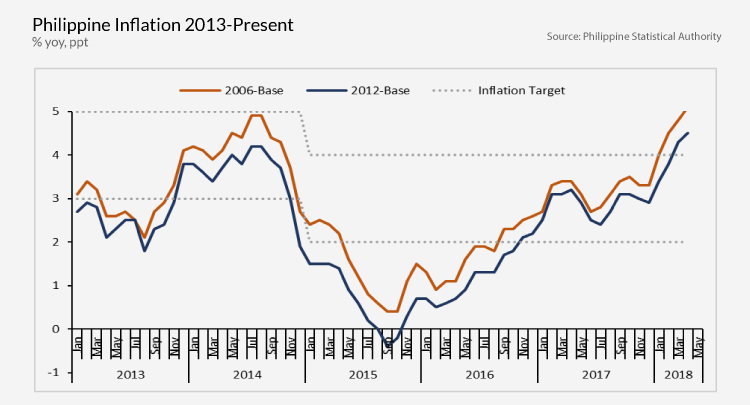

May inflation further accelerated to 4.6%. Inflation last month was observed at 4.5% and 2.9% in May 2017.

• It is fitting to note that the annual inflation food alone index at the national level has remained at 5.5% from the previous month. A slower annual rate was recorded in food and non-alcoholic beverages index at 5.7%.

• However, higher annual increases were noted in the indices of the following commodity groups: 1) Alcoholic Beverages and Tobacco (20.5%); 2) Furnishing, Household Equipment and Routine Maintenance of the House (2.9%); 3) Transport (6.2%); and, 4) Restaurant and Miscellaneous Goods and Services (3.7%).

• Previously, the BSP has considered inflation’s impact and whether it will continue to be broad-based (will cover more commodities). This latest level seems to be slower, month-on-month, and food indices seemed to have eased momentarily. BSP also noted that inflation in the National Capital Region (NCR) was slower at 4.9% compared to April’s 5.2%. Not only was it slower, it was also lower than annual inflation in Areas Outside NCR (AONCR) that settled at 4.6% compared to previous months 4.3%.

• The huge question now is: With this softer inflation, are inflation pressures easing? Will the BSP raise another 25 basis points come their June meeting? Particularly when a structural change occurs (for example, taxes are raised), upward inflationary pressures usually last about 12-18 months. Using this historical tendency, one can expect the inflation level to “normalize” (pre-TRAIN level) around June 2019. Thus, this softer May inflation maybe one off, and we will have to wait until the end of Q3 to see if inflation level is finally easing. Global oil prices are key whether or not the BSP will again pull the trigger. Furthermore, the role of monetary policy on controlling the level of inflation, at this point, may not be very effective. Other policies like fiscal or other legislative reforms such as the use of tariffs for rice (over quantitative restrictions) may help alleviate the elevated level of inflation moving forward.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion