Economic impact of enhanced community quarantine

Economy

214 week ago — 6 min read

From “Community Quarantine” of the National Capital Region (NCR) to an “Enhanced Community Quarantine” (ECQ), the Philippine government has technically locked down 73.0% of its economy and restrict the movement of people in an effort to contain the spread of Covid-19. The big question in the minds of people is: What is the economic impact of the Covid-19 spread to the Philippine economy?

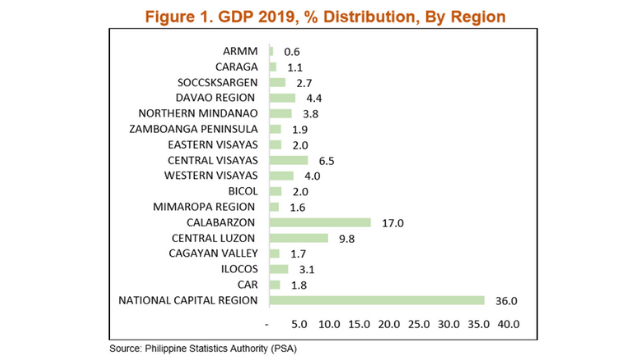

The National Capital Region (NCR) is 36.0% of total GDP, and if the whole of Luzon island (NCR, CAR, Ilocos, Cagayan Valley, Central Luzon, CALABARZON, MIMAROPA, and Bicol Regions) is considered, 73.0% of the Philippine economy is now hampered by the ECQ. For the economy to continuously run, the movement of people and goods should not be hampered. Thus, the economic impact on these particular regions will be very significant. Both Q1 and Q2 GDP growth will significantly slowdown.

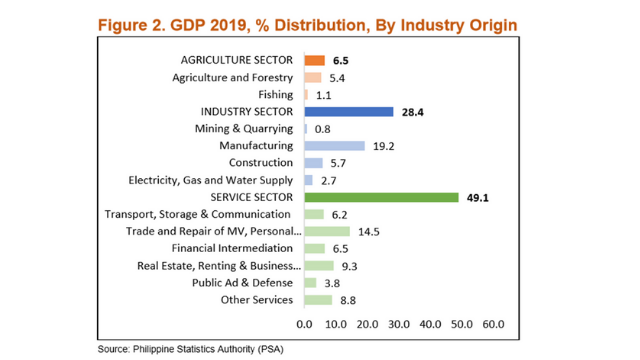

Initial assessment of the economic impact of the Covid-19 pandemic points to both tourism- and trade-related businesses. A major part of the Philippine economy is the Service Sector at 49.0% composed of services-related subsectors directly affected by the Covid-19 health scare like tourism, transport, airlines, real estate, retail, and other services. Trade-related firms, classified under manufacturing, affected are export and import companies due to China’s recent shutdown (See Figure 2).

With the ECQ, local manufacturing companies may further be hampered, as these firms are asked to limit activity to be able to implement significant social distancing. The ECQ will also impact the construction sub-sector, as the Build, Build, Build (BBB) program is expected to be disrupted. Overall, by industry origin, at most, 74.0% (Service, Manufacturing and Construction) of the economy will experience a significant slowdown.

Also read: 4 preventive measures to reduce the impact of COVID-19 on your business

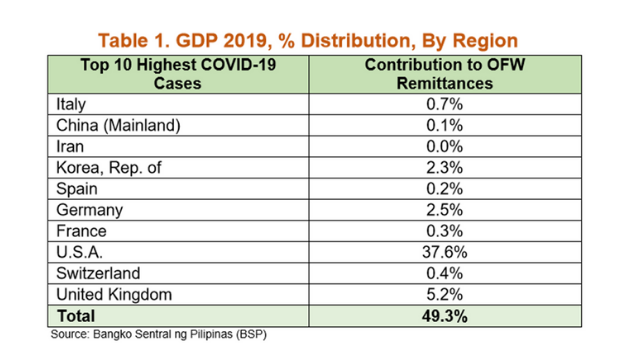

Remittance inflows are an important part of the Philippines’ consumption economy. With the Covid-19 spread, the continued contribution of this significant part of the economy may be most likely hampered. Table 1 shows the potential impact of Covid-19 on remittances.

Countries with the highest number of confirmed Covid-19 infection cases, where contributions come, constitute a total of almost 50.0% of remittance inflows. This is a significant portion of overall levels and future remittance inflows may be affected consequently for the coming months. Moreover, it is important to note that approximately 22.0% of total remittances are classified under sea-based workers.

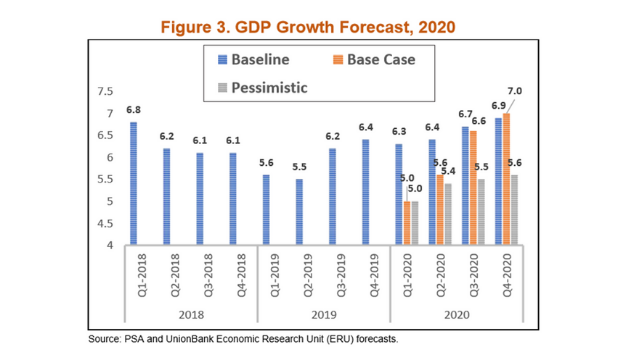

UnionBank Economic Research Unit (ERU) initially anticipated a 6.6% GDP growth for 2020 (Baseline). With the Taal eruption and the initial Covid-19 China epidemic, 2020 GDP growth was downgraded to 6.1%, a decline of 0.5% (Base Case).

The implementation of the ECQ in the whole of Luzon island, with an end of containing an obvious local community transmission of Covid-19, GDP growth is now expected at 5.4% (Pessimistic Case). As of the moment, 2020 Q1 GDP growth may now settle below 5.0% (Note that the initial expectations on both Base and Pessimistic case are at 5.0%). Specifically, ERU’s NowcastingPH1 model expects Q1 GDP growth at 4.7%, a decline of 1.6% from the Base Case’s Q1 GDP growth estimate of 6.3%.

If ECQ extends beyond the current April 12th target, Q2 GDP growth may also trend lower than previously expected. Hence, full-year 2020 GDP growth may be way lower than initially expected.

If the local virus containment efforts succeed by April 12th and the parallel global efforts also succeed (like the so-called goal of being able to “flatten the curve” of infections through the employment of different methods), then, a slight recovery can be expected in Q3 and a more robust one in Q4.

Article by: Ruben Carlo Asuncion

1 “Nowcasting” is a contraction of “now” and “forecasting” and has long been used in meteorology. As a standard measure in economics, the gross domestic product (GDP) are only determined after a long delay or lag of essential economic data release. Nowcasting models and the technique is regularly used, especially in central banks, to monitor the state of the economy in semi-real time.

Disclaimer: While this document is based on information obtained from sources we believe to be reliable, we do not make any representations as to its accuracy, completeness, correctness, timeliness or use for any particular purpose. Opinions and statements expressed here are those of their author(s) as of the date of this report and not of Union Bank of the Philippines (UBP). The opinions and statements provided in this document are subject to change without prior notice. Any recommendation contained in this document does not have regard to the reader’s particular investment objectives, financial situation and any other specific needs. This document is for informational purposes only and UBP is not soliciting any action based on it. Nothing here shall to any extent substitute for the independent investigations and the technical and business judgment of the reader. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this document or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Trending

How this sister duo got greater business exposure and sales with an online store

Ecommerce 157 week ago

5 Must-Have Emails for Your Online Store

Ecommerce 34 week ago

Comments

Please login or Register to join the discussion