Philippine Economic Outlook: Inflation expected to return to government target range in 2019

Economy

335 week ago — 3 min read

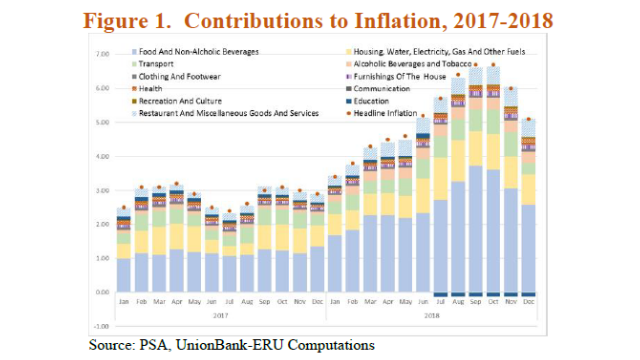

December inflation slowed down to 5.1%, following the 6.0% inflation rate in November. Market consensus was at 5.7%. The slowdown was mainly caused by slower annual increments in the indices of Food and Non-alcoholic Beverages at 6.7% and Transport at 4.0% (as shown in Figure 1 below).

Meanwhile, inflation is expected to slow down to below 5.0% by the end of the first quarter of 2019, an average of 4.0% in second quarter, 3.2% in third quarter, and 2.9% in the last quarter. This is because constraints in food supply will continue to ease due to the implementation of non-monetary measures.

Moreover, crude oil prices are expected to decline further, helping accelerate price level decline. Barring any surprises from the level of global oil prices, inflation is expected to be 3.6% for 2019 and 3.5% in 2020.

BSP may no longer hike this 2019, instead reserve requirement ration (RRR) will be cut.

As inflation eased in November, the BSP halted its tightening decisions. The overnight reverse repurchase rate was held at 4.75 percent after a total increase of 175 basis points since May.

It is unlikely that the central bank will impose further rate hikes early in 2019. A rate cut may be considered, but the BSP will instead focus on cutting the reserve requirement ratio (RRR) by 200 basis points to 16.0%.

BSP Governor Nestor Espenilla, earlier in his term, made mention of RRR cuts throughout his tenure as governor. He aims to bring the RRR to single digits by the end of his term.

With an apparently dovish US Federal Reserve this year and a Chinese economy seemingly constrained to support growth through expansionary policies, a neutral BSP monetary policy stance is more likely.

Peso may further weaken to PhP54.50

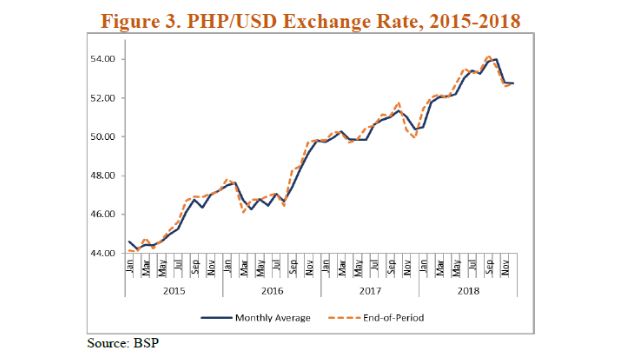

The peso depreciated by 4.8% in 2018 mainly because of the pressure on the trade balance, with weak exports and a stronger demand for imports. The peso ended 2018 at PhP52.72 from PhP49.92 in 2017 (Figure 3).

The peso bounced back from its annual low after oil prices dipped and a return to the negotiating table between the US and China began. However, the peso will continue to depreciate to PhP54.50/US$1.00 in 2019 due to the trade balance deficit pressures as the current government continues its infrastructure development push.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in this report does not constitute the opinion of UBP. Your use of this report and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the MS or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion