Growth prospects may weaken due to external risks

Economy

374 week ago — 3 min read

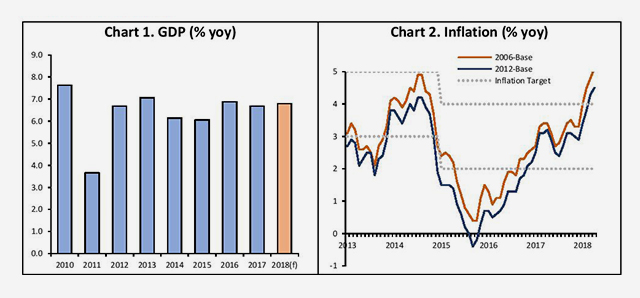

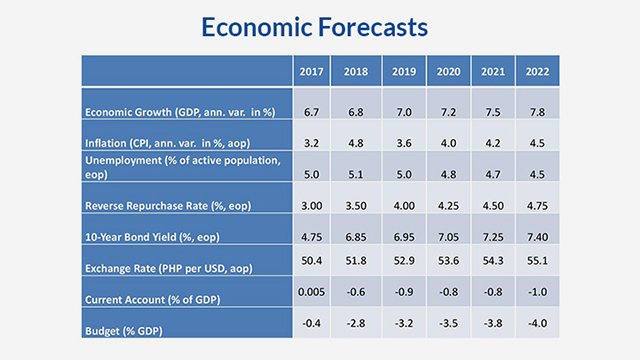

- The Philippines should remain one of the fastest growing economies in Asia over the coming years. Initially, the economy was expected to grow by 7.0% this year but economic growth may be lower than this at 6.8%

- The factors that hindered the economy to reach the expected amount are the following: 1) higher inflation due to the increase of global oil prices and, 2) regularisation of monetary policy particularly in the US.

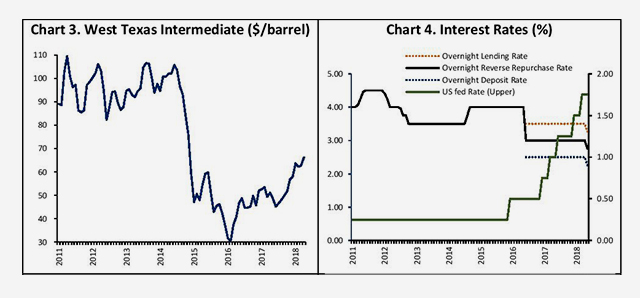

- Increasing of prices for the month of April was at 4.5% and a four-month average of 4.1% since start of the year (see Chart 2). The numbers are beyond the government’s target rate of 2-4% which made BSP (Bangko Sentral ng Pilipinas) raise interest rates by 25 points during its last May meeting.

- Inflation continues to become higher as global prices of crude oil increased to US $80 per barrel due to geopolitical concerns. Although, it must also be pointed out that global oil prices have lowered by 8% since last week due to the indication of oil-exporting countries that supply will increase very soon (see Chart 3).

- The expectation of higher interest rates are putting pressure on Philippine markets. This has been seen in the recent increase of interest rate by the BSP which they described as, “token” hike.

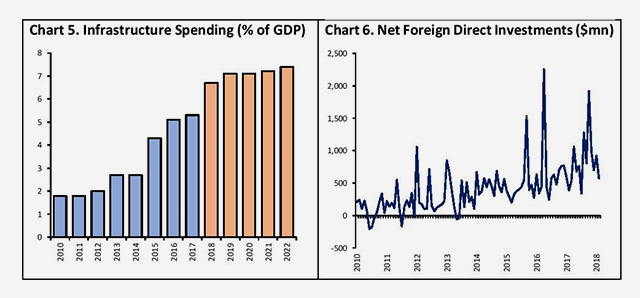

- However, the key driver of the economy in the coming years is the growing spending on infrastructures.The first package of tax reforms or the TRAIN is set to raise revenues which is equivalent to 1.0% of GDP (Gross Domestic Product) or the national income of the Philippines. This will provide the government with resources to spend on infrastructures. Infrastructure investment is targeted to hit 6.0% of the GDP or national income by the year 2020 and 7.1% by the end of the Duterte administration (see Chart 5).

- The local political noise has not affected foreign investments during the first two months of 2018. Net inflows from these investments, for January and February rose by 52.6% to about US $1.5 billion. This reflects the confidence and the trust of foreign investors in the stable Philippine economy and growth rate.

- Overall, despite an unpredictable external environment, it is also important to take note of the fast adaptability of the Philippine economy in past global economic or financial crises.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Trending

What is the Curse of Knowledge? How Does it Impact Communication?

Learning & Development 23 week ago

Learning & Development 61 week ago

Comments

Share this content

Please login or Register to join the discussion