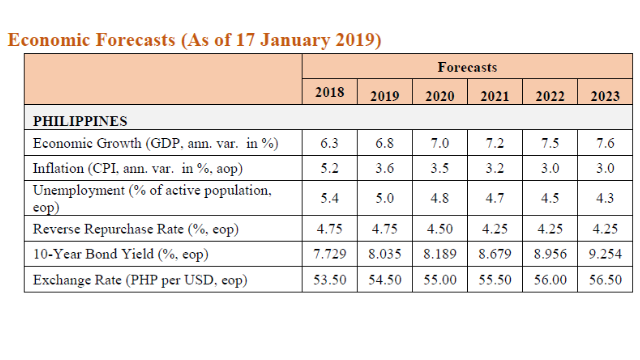

Philippine Economic Outlook: Economic growth in 2019 is expected at 6.8%

Economy

341 week ago — 4 min read

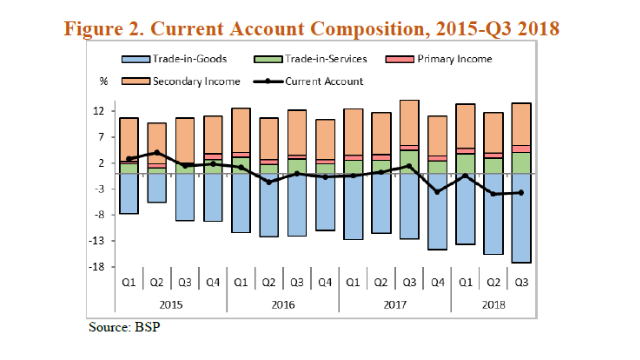

The Balance of Payments (BoP) position registered a higher deficit of US$1.9 billion in the third quarter compared to the US$662.0 million deficit recorded in the same quarter in 2017. The high deficit was due to the continued widening of trade-in-goods deficit and the lower net receipts of services and secondary income. Strong growth in domestic economic activity drove the sustained expansion of imports of goods.

Meanwhile, the financial account recorded net inflows, which is contrary to the net outflows in the same period last year. Direct investments remained robust and net inflows, investor sentiment, and global growth prospects remained positive for the next year.

Net foreign direct investment inflows for 2018 are expected to reach about the same as 2017 at about US$10 billion. 2019 FDI is again expected to be robust as the Philippines and other regional neighbors become beneficiaries of the unsettled US-China trade showdown. Even if a trade agreement comes into fruition in the near future, the Philippines still remains to be one on the map of potential investors.

The Philippines incurred a CA deficit of $6.5 billion in the first nine months of 2018, -786.6% lower than the same period in 2017. The CA deficit is expected to continue in 2019 as the Duterte government continues its infrastructure push. Demand for imports have increased and 2018 exports’ weakness was highlighted (Figure 2).

Q4 GDP growth expected at 6.4%; 2018 full-year GDP at 6.3%

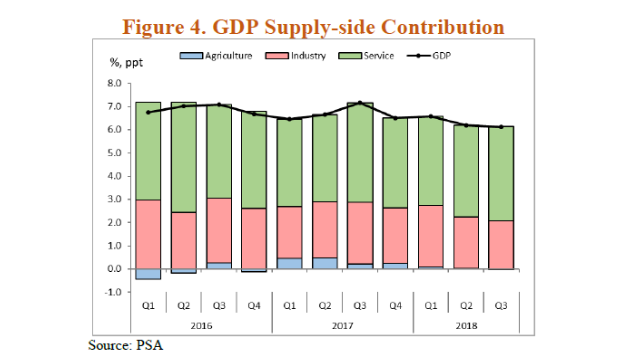

The Philippines’ GDP grew by 6.1% in the third quarter, mainly due to the Trade, Manufacturing, and Construction sectors (Figure 4).

NowcastingPH1 forecasts Q4 GDP growth at 6.4%2. Economic expansion may have been largely driven by strong manufacturing demand as evidenced by Q4 as the strongest quarter for 2018 in terms of the seasonally adjusted Nikkei Philippines Manufacturing Purchasing Managers’ Index (PMI) that measures manufacturers’ business and demand appetite.

Furthermore, the improvement of domestic consumption due to easing inflation, coupled by holiday spending, pushed Q4 higher in spite of the weakness in agriculture production. Government spending may have also driven economic growth as it has in much of 2018. Full-year GDP economic growth for 2018 is expected at 6.3%.

As inflation pressures ease, 2019 economic growth is expected to surprise at 6.8%. This is not to mention that 2019 is an election year, thus a spending year that will further drive domestic demand. Public and private construction, supported by strong and continuing public expenditure on various infrastructure development projects.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in this report does not constitute the opinion of UBP. Your use of this report and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the MS or any of its contents.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion