Impact of TRAIN Law

Economy

383 week ago — 2 min read

The TRAIN law basically hinges on the reduction of current personal income taxes of the larger tax-paying public. This is a larger part of the government's move to initiate the biggest tax changes in our old tax structures. The Comprehensive Tax Reform Program or CTRP is the bigger plan to make the current tax regime to a more modern and efficient one.

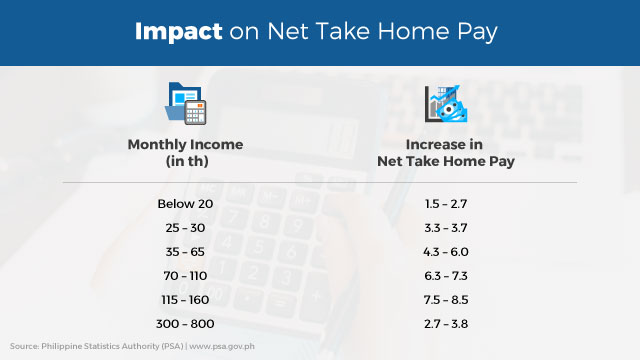

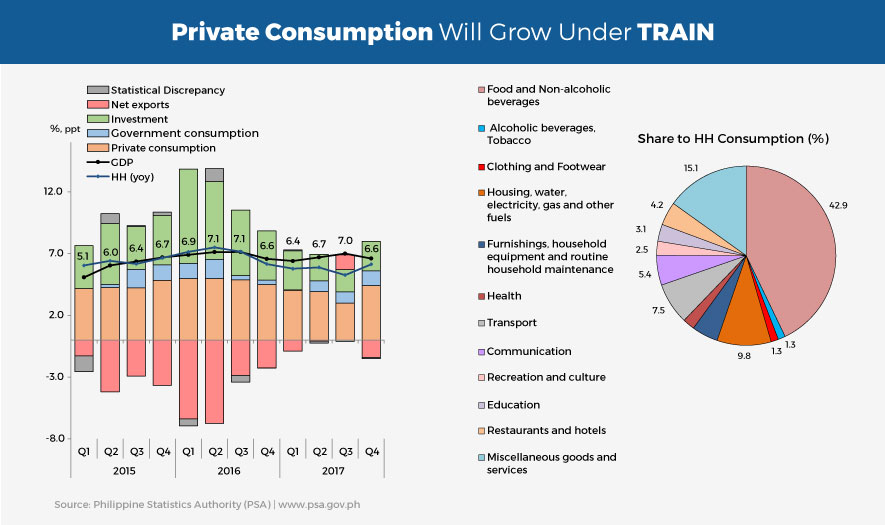

The biggest impact of the TRAIN law is that there will be higher take-home pay for many of the taxpayers, and this will, in turn, increase private consumption. Simply put, additional money in the pocket of people will translate to either more spending or more opportunities to save or invest. The increase in demand would now then translate to more goods and services that needs to be produced helping the economy grow and expand further.

TRAIN will impact basic take home pay.

- 6 million or 86% of compensation earners are now tax-exempt.

- Those earning between PhP250K-2 million will now pay 20-30% tax from 30-32%, previously.

- 13th month pay and other bonuses not exceeding PhP90K are tax-free.

Household consumption will continuously grow because of TRAIN (blue line on the left represents household consumption growth).

- More will be spent according to how current household consumption is being allocated (see pie chart).

- More for food and non-alcoholic beverages; more demand for housing requirements; and, others.

Article by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion