Unprecedented: COVID-19 and its impact on the Philippine economy

Economy

274 week ago — 6 min read

The International Monetary Fund recently referred to the COVID-19 pandemic as the “Great Lockdown 2020” that has created a global financial crisis that is expected to be worse than the “Great Depression”. This unprecedented pandemic brings so much uncertainty in the global economy and projecting its full impact has become a huge challenge.

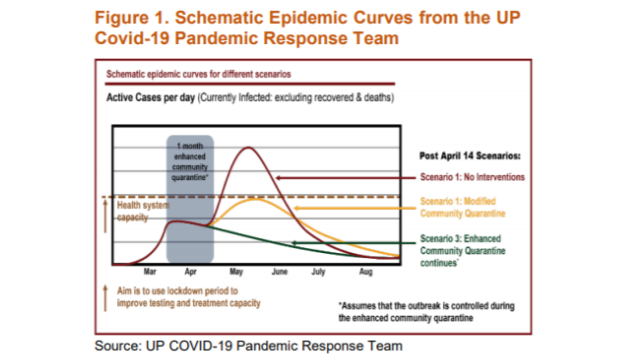

This note will discuss two (2) scenarios for the Philippine economy: 1) Optimistic case; and, 2) Worst-case. The Optimistic case was largely based on the UP COVID-19 Pandemic Response Team’s epidemic scenarios (Figure 1), where a Modified Community Quarantine (MCQ) will take effect after the Enhanced Community Quarantine (ECQ) on April 30th, in order to flatten the infection curve without paralyzing the domestic economy.

Also read: Is response to COVID-19 pandemic enough?

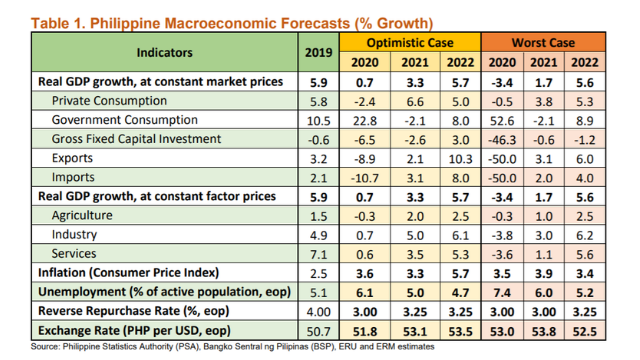

An OECD initial impact assessment paper puts the decline in annual GDP growth for each month of strict virus containment measure, such as the ECQ over Luzon island, can shave off as much as two (2) percentage points. Our initial 2020 GDP expectation of 6.6% growth declines to 4.6%, but the initial expectation was already previously adjusted to 6.3% in anticipation of the impact of the COVID-19 outbreak in Wuhan, China last January.

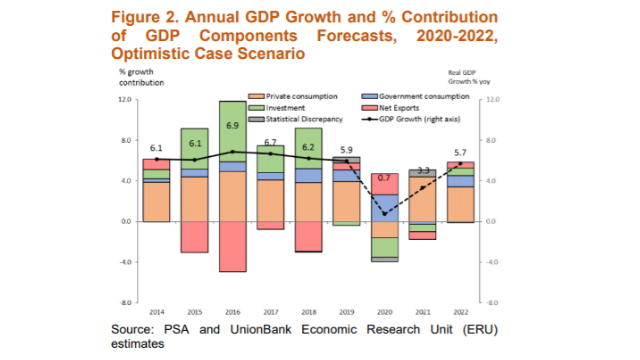

An MCQ is expected to be implemented after the April 30th ECQ deadline. MCQ is a location-specific quarantine scenario that includes social (physical) distancing, elimination of check-points, reduced public transportation, no general congregation, and schools remain to be closed. The UP COVID-19 Pandemic Response Team has come up with a program on how to implement community quarantine after April 30. We think that an MCQ may be required until August to help the country’s health system capacity be not overwhelmed, and we roughly estimate an equivalent decline in GDP growth of about 1.0% for every month of MCQ implementation. Probable GDP growth for 2020, with an MCQ until August plus the ECQ, may potentially settle to less than 1.0%. Using our NowcastingPH4 model with assumptions of 10-30% decline in both exports and imports, 16-18% decrease in OFW remittances, and an employment rate of 7-9%, GDP for 2020 may hover between 0.7% to 2.2% for the Optimistic case. Figure 2 describes a “check-type” or a “Nike swoosh-like” of economic recovery for the Philippines.

Also read: UnionBank CEO tips coronavirus to end cash, accelerate bank's digital plans

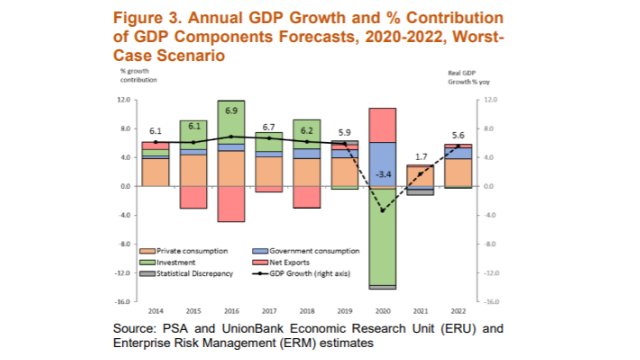

The Worst-case scenario is predicated on the US Federal Reserve’s “rolling shutdowns” scenario, as the outbreak recedes and a flattening of the curve happens, infections flare back up again when the economic controls are relaxed. This scenario is also patterned after the W-Shape scenario wherein the efforts to control the pandemic are loosened prematurely, the virus stage could comeback. This scenario bares the critical assumption that the return to normalcy is hinged on the availability of an effective anti-viral treatment or drug and/or an already widely available working vaccine versus COVID-19. This Worst-case scenario involves multiple resurgence of the virus that would merit the return of tightened quarantine measures equivalent to an ECQ. In our simulations, the month of August this year and January 2021 are anticipated months of COVID-19 cases resurgence, and March 2021, as a probable month when a vaccine may be discovered (This is from an optimistic premise that it usually takes 12-18 months for a vaccine to be readily available). In this Worst-case scenario, GDP growth 2020 sags to -3.4%.

A common theme of both scenarios is the cratering of private consumption and a major drying up of investments as most businesses stop operations eventually in the second quarter of 2020. Figure 3 also shows a “check-type” or a “Nike swoosh-like” recovery path for the economy. Government support differ between scenarios because of the nature of the containment efforts, with the Worst-case to merit higher government stimulus. Overall, there are still many unknowns, and these scenarios will continue to evolve as more data becomes available.

Article by: Ruben Carlo Asuncion

Disclaimer: While this document is based on information obtained from sources we believe to be reliable, we do not make any representations as to its accuracy, completeness, correctness, timeliness or use for any particular purpose. Opinions and statements expressed here are those of their author(s) as of the date of this report and not of Union Bank of the Philippines (UBP). The opinions and statements provided in this document are subject to change without prior notice. Any recommendation contained in this document does not have regard to the reader’s particular investment objectives, financial situation and any other specific needs. This document is for informational purposes only and UBP is not soliciting any action based on it. Nothing here shall to any extent substitute for the independent investigations and the technical and business judgment of the reader. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this document or any of its contents

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion