3Q GDP’s upturn of 8% QoQ SA (Part 1)

Economy

240 week ago — 10 min read

Key Takeaways:

• Larger-than-expected 3Q GDP decline of - 11.5%YoY (survey: -9.6%/UBP: -10.6%) need not deflect focus away from GDP’s sequential gain of 8%QoQ SA

• On the demand side, real investments sunk further while government consumption grew mildly. Consumption was down 9.3% compare to a year-ago but against all odds, it bounced back by 8.8%QoQ SA versus 2Q. De-stocking slashed 2.4% of 3Q GDP while the export decline eased

3Q domestic demand fell by 14.6% vs a yearago--a slight improvement over the 2Q drop of 15.6%

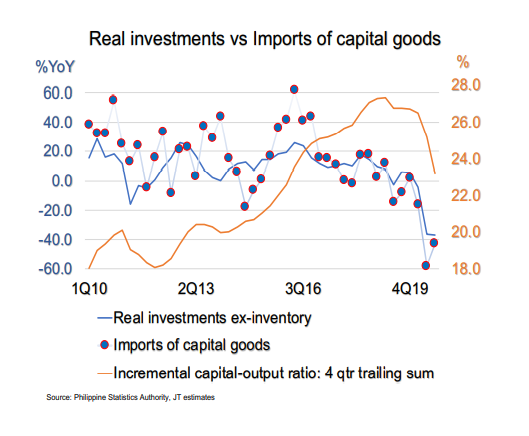

Largest contributor to the 3Q GDP expenditure decline was real investments (excluding inventory). It shrunk by 37% yearon-year to slightly exceed the 2Q investment collapse. We estimate that nearly 65% percent of headline GDP’s negative print was due to the hefty investment drag for the second straight quarter. It also implied a less-thanideal job market that would take its toll on consumer spending and confidence.

It was a surprise to see a hefty drop in construction of 43.5% year-on-year while investments in durable equipment declined by 34.4%. The breakdown showed public construction narrowed by 28% as private contractors struggled to comply with tight business/social pandemic controls amid a ‘realigned’ PWH budget down to just above Php500bn this year. Residential housing (- 59.2%) and industrial construction (-38.7%) posted larger drops in 3Q facing familiar logistical/health challenges posed by the pandemic. Bearish private construction was also due to stalled private property development projects driven by expectations of soaring vacancy rates in Metro Manila’s residential and office property markets amid the economic crisis, e.g, more bankruptcies, and exiting expats including POGO’s departure.

Another material quarterly decline in business capital spending (durable equipment) was led by a 40% compression of investments in transport (road, air, water and railway). Other types of machinery from specialized machinery, e.g., telecoms & sound recording equipment, generalized machinery, e.g., compressors, and other miscellaneous equipment posted declines. Silver lining in this investment segment was the 35.9% increase in office machinery and data processing equipment (or computers and related hardware). Key takeaway with sustained investment slump in construction and durable equipment is hiring or re-hiring potential is much at risk while new jobs created may not necessarily reinstate preCovid wages (less full time work).

De-stocking persisted (including rice and other agricultural commodity stocks) at the macro level in 3Q as it slashed 2.4% of GDP (vs 2Q: - 5.4% of GDP).

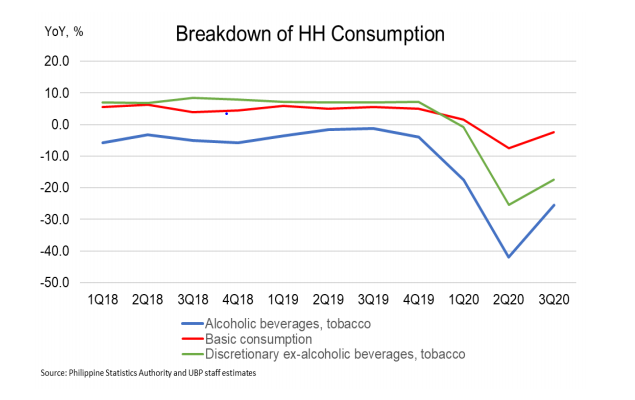

Household consumption fell by 9.3% year-onyear in 3Q20 for a -6.6 ppt drag to headline GDP. Consumption bounced back in 3Q with +8.8%QoQ SA (vs 2Q: -14.1%QoQ SA). While purchasing power losses and virus contraction fears persisted and weighed on household consumption, we noted that broad food demand grew 4.6% year-on-year in 3Q as consumers prioritized essentials. Despite this, what we define as basic expenditures in an EM market: broad food, rental, electricity, cooking fuel, water, and transport, still declined by 2.3%. Rent and other household utilities grew by a hefty 6.7% with WFH arrangements and online learning in the urbanized communities. These stay-at-home factors deflated consumer demand for transport services by 33.4% during the quarter. This sunk basic consumption in our estimate.

Restaurants & hotels (-50% year-on-year) and recreation & culture (-59.3%), education (- 20.8%), and clothing & footwear (-13.9%) were discretionary demand components that posted hefty drops in 3Q20. Excluding alcoholic beverages & tobacco, discretionary consumption compressed by a collective 17.4%. Meanwhile consumption of alcoholic beverages & tobacco shed 25.5%.

Government consumption grew by a modest 5.8% after Bayanihan I. On a weighted basis, government expenditures contributed +0.7 ppt to headline GDP growth. Lackluster fiscal spending was in line with 3Q primary fiscal expenditures down 19.4%QoQ vs robust 2Q growth of 50%QoQ with Bayanihan I.

Also read: Easing the burden through Bayanihan II's tax breaks

Driven by shipments of semi-conductor electronics (+1.5% year-on-year), commodity export volume fell 2.2% year-on-year--a sharp improvement over its 30.8% drop in 2Q. This is in sync with recent Customs export data1 that flagged a 6.7% compression in its 3Q dollar value following a 29.2% collapse in 2Q.

The vaunted BPO flows were hardly felt as business services on the service receipts side declined by 6.5% year-on-year alongside massive shrinkage in the other major contributors: telecoms, computer & information services (-31.1%) and travel (-80.2%). Export of services in 3Q narrowed by 32.8%.

Meanwhile imports of electronics with more than a quarter’s share of total imports, reported a 4.3% year-on-year decline. This was better than the 19.7% contraction of headline imports. Imports meant for the domestic market: fuel/oil products (-25.7%), industrial machinery & equipment (-28.3%), base metals (-19.4%) and transport equipment (-58.6%), underpinned sharply receding 3Q imports. With improving exports and fading imports, the net trade (exports - imports) eased to -6.4% of 3Q GDP.

Market Narratives by Jun Trinidad

No Warranties and No Liability

Basic information used in Market Narratives and MktsFocUs and other market/economic commentaries by senior staff of Union Bank of the Philippines (“UBP”) were sourced from news articles of several foreign and local broadsheets and news and market-based websites. As such, its contents are not owned by nor have been written or prepared by UBP. UBP does not own any of the contents of the Narratives, MktsFocUs and others and as such does not have any right to grant any rights to recipients. The terms and conditions of your use of the contents of the Narratives are governed by the rights granted and restrictions imposed by the source and/or owner of the contents and the same are subject to all applicable international and local laws and regulations.

Although the contents have been obtained from sources believed to be reliable, they are provided to you as presented, without any recommendations or warranties of any kind from UBP. UBP, its officers, directors, employees and agents cannot and do not make any representations and disclaim all warranties, express or implied, in respect of the Narratives and MktsFocUs and its contents, including, but not limited to, guarantees, representations and warranties regarding truth, adequacy, reasonableness, accuracy, timeliness, completeness, non-infringement, merchantability, satisfactory quality, or fitness for any particular purpose, or any representations or warranties arising from usage, custom or trade by operation of law. UBP, its, officers, directors, employees and agents assume no responsibility for the consequences of any errors, inaccuracies or omissions in the Narratives and MktsFocUs and other market-related publications.

Any opinion or statement in the Narratives, MktsFocUs, and other market publications does not constitute the opinion of UBP. Your use of the Narratives, MktFocUs and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on these market commentaries/research products.

The Narratives and MktsFocUs and related market commentaries are provided to you as a free service and on an “as is or as available” basis. As such, UBP does not guarantee the distribution of these research-based products will be regular, timely or uninterrupted. UBP, its officers, directors, employees and agents do not assume any responsibility for consequences of any non-delivery or non-provision, errors, delays, omissions, interruption, breach of security or corruption in connection with these market/research products, notwithstanding any prior advice of such possibilities.

UBP likewise does not guarantee, represent or warrant that the Narratives and MktsFocUs or any of its contents, including but not limited to links found in the contents, are free of malicious software, including, but not limited to, viruses, computer worms, spyware or other harmful components ("Malicious Software"). UBP, its officers, directors, employees, and agents do not accept any liability for any loss, damage, claim, liability, expense or costs arising or that may result from any transmission of such Malicious Software through these market /research products including, but not limited to files downloaded from the Narratives and MktsFocUs or from the compiling, interpreting, editing, reporting or delivering these bank research products.

In no event shall UBP be liable to you or to anyone else for any claim arising out of or relating to the Narratives and MktsFocUs, including but not limited to direct, consequential, special, incidental, punitive or indirect damages, even if advised of the possibility of such damages. UnionBank of the Philippines is supervised by the Bangko Sentral ng Pilipinas.

For concerns, you can contact us at (02) 841-8600 or customer.service@unionbankph.com or the BSP Financial Consumer Protection Department at (02) 708-7087 or consumeraffairs@bsp.gov.ph

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion