The Philippines catches the cold...

Economy

276 week ago — 6 min read

The World Health Organization (WHO) has officially named the new coronavirus as “CoViD-19” or the Coronavirus Disease of 2019. A recent change in diagnosis methodology saw a surge in the number of coronavirus cases, jolting the sense of optimism seen in recent days about the infections seemingly slowing down.

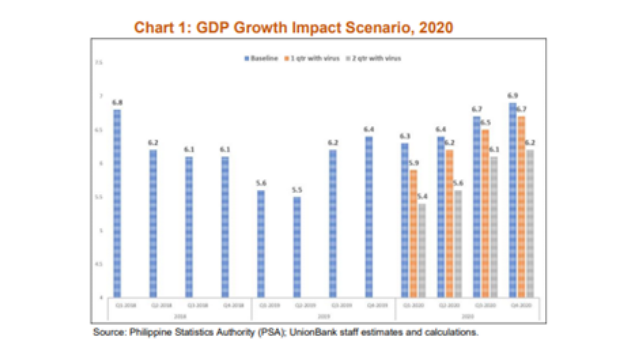

As a matter of prudence, shown here are possible economic impact scenarios for the Philippine economy, both three (3) and six (6) months. These are for GDP growth, inflation and monetary policy.

Chart 1 describes GDP growth that if the CoViD-19 outbreak were to linger for 3 months, annual GDP growth for 2020 will settle at 6.3% (Initial baseline for 2020 GDP growth was at 6.6%). If, by some reason, the spread lasts to about 6 months, annual GDP growth for 2020 will be at 5.8%. These two scenarios mimic the work of Fan (2003) on the economic impact of SARS.

The sharp decline of Chinese tourists due to the temporary travel bans is an immediate hit on the Philippine tourism industry (See “When China Sneezes” report). Tourism revenue is about 12.7% of total GDP in 2018, and Chinese tourists are the second largest number of visitors in the country. Furthermore, the outbreak will also impact regional travel and tourism simply because of the fear of the unknown. This, eventually, will affect travel plans of other foreign visitors magnifying further the drop in tourism receipts as the spread continues.

The supply chain disruptions, brought about by the COVID19 spread, will have a negative impact on Philippine exports (China imports). Even imports from China may also be particularly affected as factories and other manufacturing firms close down momentarily to control the spread of the said virus. The expected strong and consistent recovery of the export sector in 2020 may have to wait until the spread is contained and businesses go back to normal in China. On the other hand, imports may improve ahead of exports as the Duterte government resumes its “double stimulus” through infrastructure development and social services spending.

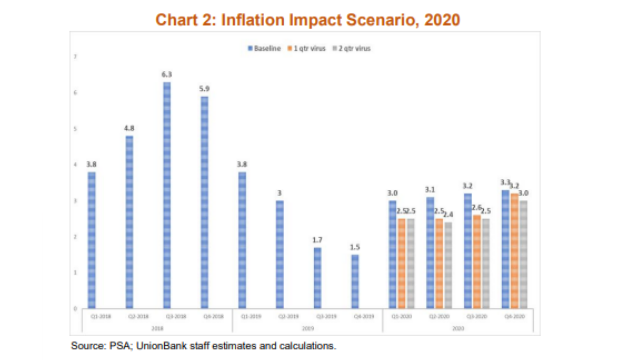

2020 inflation was revised to 3.2%, but may have to be reviewed again because of the COVID-19 outbreak. If the virus spread lasts 3 months, inflation may decline to an annual average of 2.7%. For a 6-month scenario, inflation is expected to settle at 2.6%.

China accounts for about 20.0% of the demand for global oil. With the COVID-19 scare, the OPEC has dramatically lowered its forecast for oil demand growth this 2020, and global oil price has fallen to around 20.0% since January this year, dragged down by lower demand by China during this coronavirus outbreak.

Barring any surprises from other geopolitical risks, Philippine inflation is expected to decline this 2020. The probable decline is still largely based on the duration of the COVID-19 spread and its immediate containment and has obvious impact on monetary policy moving forward.

The BSP, through Governor Ben Diokno, telegraphed that there is still room for easing of about 50 bps this 2020, and so far, 25 bps has already been delivered. With the difficulty of assessing the economic impact of the COVID-19 health scare to China and to the region, UnionBank’s Economic Research Unit (ERU) thinks that the other 25 bps cut may be pushed earlier than expected. Furthermore, if and when the outbreak lasts longer than anticipated (SARS outbreak lasted about 7-8 months), there may be more easing actions from the Philippine central bank to help cushion the impact on economic growth.

Article by: Ruben Carlo Asuncion

References:

- Fan, E.X. (2003). SARS: Economic Impacts and Implications. Asian Development Bank, ERD Policy Brief Series, No.15. Manila, Philippines.

- Raga & te Velde (2020). Economic vulnerabilities to health pandemics: Which countries are most vulnerable to the impact of corona virus, Overseas Development Insitute, Supporting Economic Transformation.

- Qui, W. et al (2018). The Impacts on Health, Society, and Economy of SARS and H7N9 Outbreaks in China: A Case Comparison Study. Journal of Environmental and Public Health, Volume 2018.

Disclaimer: While this document is based on information obtained from sources we believe to be reliable, we do not make any representations as to its accuracy, completeness, correctness, timeliness or use for any particular purpose. Opinions and statements expressed here are those of their author(s) as of the date of this report and not of Union Bank of the Philippines (UBP). The opinions and statements provided in this document are subject to change without prior notice. Any recommendation contained in this document does not have regard to the reader’s particular investment objectives, financial situation and any other specific needs. This document is for informational purposes only and UBP is not soliciting any action based on it. Nothing here shall to any extent substitute for the independent investigations and the technical and business judgment of the reader. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on this document or any of its content

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Most read this week

Trending

Comments

Share this content

Please login or Register to join the discussion