Vaccine lift, cut by Ulysses

Economy

239 week ago — 9 min read

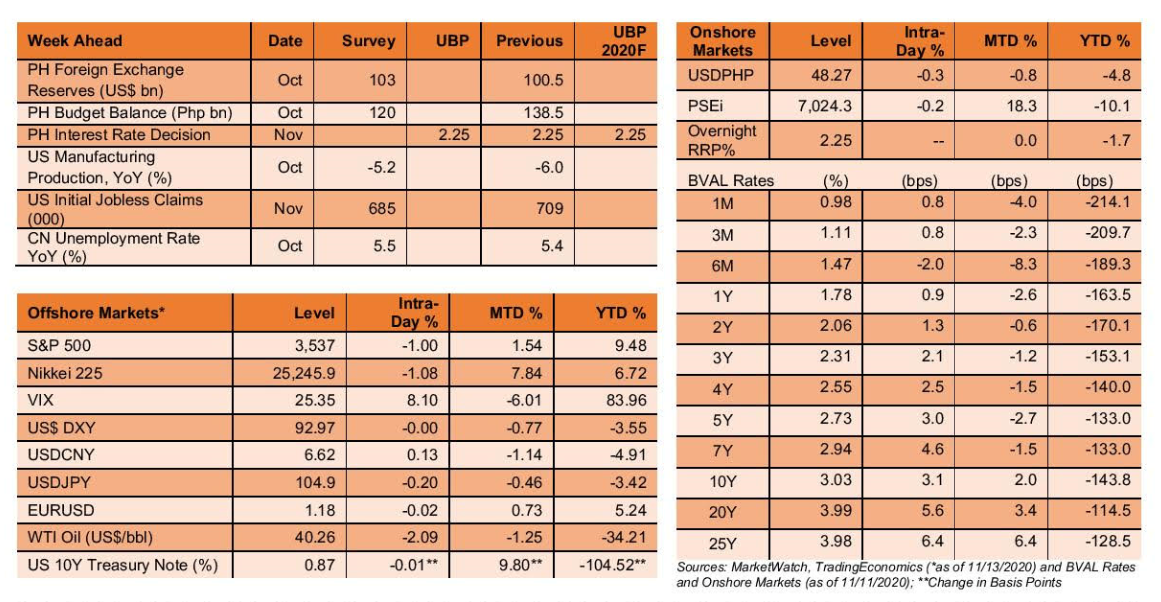

BVAL rates forecast ranges: 5yr 2.730% - 2.820%; 10 yr: 3.10% - 3.18%

Tactical buy on short-duration/Neutral on the curve’s belly/Receive long end on dips

Week ahead (Nov 16 - Nov 20): We expect Monetary Board to keep its powder dry in its scheduled meeting on the 19th although an RRR cut may be a possibility (Bloomberg). 3Q GDP’s silver lining (+8%QoQ SA), subdued credit demand amid hefty broad liquidity gains, and food CPI’s reaction to the ‘storm surge’ although a one-off, may anchor BSP’s policy rate decision. Alongside the budget deficit in October headed for a record high quarterly fiscal gap (UBP 4Q20 budget deficit: Pph 643bn) and this month’s 5 yr government debt sales, the cutback in duration will persist. A steeper US treasury curve reinforces this likelihood. We look for curve steepeners beginning with more upside pressures in the liquid belly.

Previous week’s recap (Nov 09 – Nov 13): Short-duration bias was evident in trading amid light volume before the 3Q GDP release. Disappointing 3Q GDP did not diminish this preference for short tenors as the 5yr and 10yr BVAL rates closed Wednesday’s session up by 3bp intra-day. Bias for trimming duration won’t be distracted by typhoon effects that may trigger food price.

USDPHP forecast range: 48.10 – 48.50

Tactical sell USD/Long-term underweight PHP

Week ahead: Excitement over the vaccine news was cut short by upsurge in case infections in the US/Europe and some global Central Bank officials warning of risks of delays in the vaccine rollout, logistics, production and access. Lacking 4Q fiscal stimulus although there’s talk of another round of renegotiations in the lameduck US Congress as COVID-19 stateside cases soar, may handicap USD this week. If recent trading sessions offers any indication, commercial flows from remittance providers, BPO conversions for payroll and others, heavily favored PHP. On balance, USDPHP will perisist in probing the psychological barrier of 48 for the rest of the year. For this week, the range of 48.10-50 may hold with the currency pair testing the low barrier subject to BSP intervention. Data releases and BSP’s scheduled policy meeting this week will be neutral to USDPHP.

Previous week’s recap: A global risk-on backdrop following the upbeat Pfizer’s vaccine report early in the week didn’t last. Markets turned sober with connections on higher case infections in the US/Europe and subsequent government moves to clampdown on mobility and social gathering. USDPHP was focused on alternating global risk sentiment that disappointing 3Q GDP barely made a difference. The local pair closed at 48.27 as of Wednesday before typhoon Ulysses hit.

PSEi forecast range: 6,700 – 6,900

Buy index stocks on dips

Week ahead: The anticipated global event of large scale vaccine production and distribution will be months down the road. Surging case infections in the US/Europe and subsequent government restrictions/lockdown response sans US fiscal stimulus, will dominate near-term market sentiment. Lacking major local data releases, BSP’s policy meeting on the 19th will be awaited. Food price upticks due to ASF and the sequence of typhoons, excess liquidity risk and ‘half-full’ version of 3Q GDP (+8%QoQ SA) support unchanged policy rates in our view. Against this backdrop, market preference to harvest recent PSEi profits will persist. Our trader’s year-end target remains at 6,500 – 6,700 as the latest rally was for the most part sentiment and liquidity driven. Buy index stocks on dips.

Previous week’s recap: Larger-than-expected 3Q GDP decline failed to derail PSEi’s ascent to a tick above 7,000 on Tuesday. Positive news on Pfizer’s vaccine trials (90% effective in preventing COVID-19) was a global catalyst. PSEi’s slight correction ensued in the next trading session but still above 7,000. We end the week with profit-taking after the typhoon beating on NCR, CALABARZON and other Luzon provinces, coupled with higher US/Eurozone case infections causing the pullback of global risk-on.

Image Source: Freepik

No Warranties and No Liability

Basic information used in Market Narratives and MktsFocUs and other market/economic commentaries by senior staff of Union Bank of the Philippines (“UBP”) were sourced from news articles of several foreign and local broadsheets and news and market-based websites. As such, its contents are not owned by nor have been written or prepared by UBP. UBP does not own any of the contents of the Narratives, MktsFocUs and others and as such does not have any right to grant any rights to recipients. The terms and conditions of your use of the contents of the Narratives are governed by the rights granted and restrictions imposed by the source and/or owner of the contents and the same are subject to all applicable international and local laws and regulations.

Although the contents have been obtained from sources believed to be reliable, they are provided to you as presented, without any recommendations or warranties of any kind from UBP. UBP, its officers, directors, employees and agents cannot and do not make any representations and disclaim all warranties, express or implied, in respect of the Narratives and MktsFocUs and its contents, including, but not limited to, guarantees, representations and warranties regarding truth, adequacy, reasonableness, accuracy, timeliness, completeness, non-infringement, merchantability, satisfactory quality, or fitness for any particular purpose, or any representations or warranties arising from usage, custom or trade by operation of law. UBP, its, officers, directors, employees and agents assume no responsibility for the consequences of any errors, inaccuracies or omissions in the Narratives and MktsFocUs and other market-related publications.

Any opinion or statement in the Narratives, MktsFocUs, and other market publications does not constitute the opinion of UBP. Your use of the Narratives, MktFocUs and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on these market commentaries/research products.

The Narratives and MktsFocUs and related market commentaries are provided to you as a free service and on an “as is or as available” basis. As such, UBP does not guarantee the distribution of these research-based products will be regular, timely or uninterrupted. UBP, its officers, directors, employees and agents do not assume any responsibility for consequences of any non-delivery or non-provision, errors, delays, omissions, interruption, breach of security or corruption in connection with these market/research products, notwithstanding any prior advice of such possibilities.

UBP likewise does not guarantee, represent or warrant that the Narratives and MktsFocUs or any of its contents, including but not limited to links found in the contents, are free of malicious software, including, but not limited to, viruses, computer worms, spyware or other harmful components ("Malicious Software"). UBP, its officers, directors, employees, and agents do not accept any liability for any loss, damage, claim, liability, expense or costs arising or that may result from any transmission of such Malicious Software through these market /research products including, but not limited to files downloaded from the Narratives and MktsFocUs or from the compiling, interpreting, editing, reporting or delivering these bank research products.

In no event shall UBP be liable to you or to anyone else for any claim arising out of or relating to the Narratives and MktsFocUs, including but not limited to direct, consequential, special, incidental, punitive or indirect damages, even if advised of the possibility of such damages. UnionBank of the Philippines is supervised by the Bangko Sentral ng Pilipinas.

For concerns, you can contact us at (02) 841-8600 or customer.service@unionbankph.com or the BSP Financial Consumer Protection Department at (02) 708-7087 or consumeraffairs@bsp.gov.ph

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Most read this week

Trending

Comments

Share this content

Please login or Register to join the discussion