Automotive Industry Review - July 2018: Auto sales drop, expected to recover

Economy

364 week ago — 4 min read

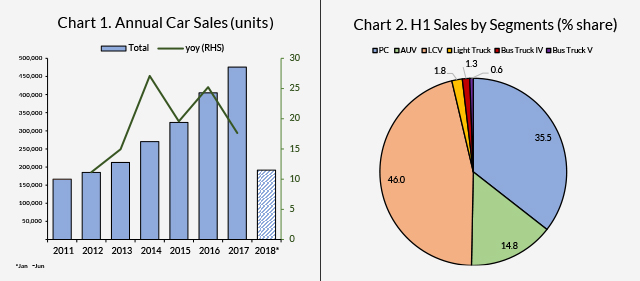

Sales of automobiles in the Philippines are experiencing a slowdown in the first half of 2018 (H12018) as compared to equivalent sales number in the first half of 2017 (H12017). Despite this statistic, auto sales are expected to recover given growth in OFW remittances and the settling down of the after effects of the tax reform. An analysis of the automotive industry for H1-2018 is provided.

Highlights

• According to the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA), vehicle sales in the first six (6) months of the year totaled 171,352 units, down by 12.5% compared to the same period in 2017.

• The Association of Vehicle Importers and Distributors (AVID) saw an 11% decline in sales at 43,138 units. This brings the industry’s total sales down by 12.24% to 191,470 from the 281,170 units sold in H12017.

Breakdown of market share by car type and industry leaders

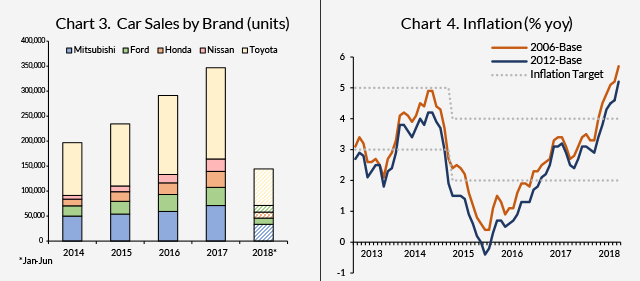

- Commercial vehicle (CV) sales continue to take significant share of the market with 64.46% and Passenger Vehicle (PV) with 35.54%. Light Commercial Vehicle (i.e., Pickup, SUV, Van) contributed 46% of market share followed by Action Utility Vehicle / Multi-purpose (14.8%), Light Truck (1.8%), Bus Truck IV (1.3%) and Bus Truck V (0.6%).

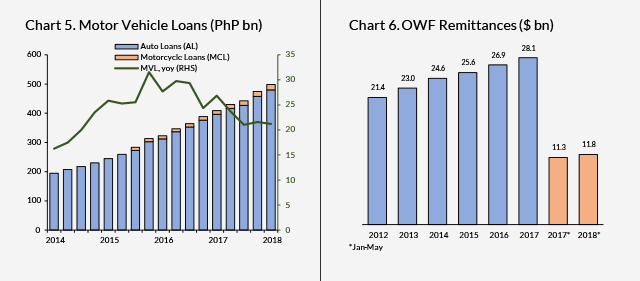

- In the first semester, Toyota Motor Philippines Corp. remained the industry leader with 38.2% market share, followed by Mitsubishi Motor Philippines Corp. (17.5%), Hyundai Motor Company (7.96%) Nissan Philippines Inc. (6.91%), Ford Motor Company Philippines Inc. (6.42%), and Honda Cars (6.28%).

Economic factors inhibiting automobile sales

• Economic headwinds slowed down auto sales from Jan-Jun 2018. The Tax Reform for Acceleration and Inclusion (TRAIN) Act continues to take its toll on driving auto prices up. The market is still adjusting to the new excise tax regime.

• Excise taxes from automobile fell short of the PhP3.4 B goal. Collections amounted to PhP2.92 B, 40.62% higher than the PhP2.08 B last year.

- Inflationary pressures will continue to make big ticket items like automobiles less favorable to consumers. With the higher cost of goods, consumers are prioritizing their need for basic goods and services.

- Increase in oil prices could be a factor impacting car sales. As of Jul 10, 2018, the common price for diesel is PhP44.85/liter and PhP54.6/liter of gasoline. This is higher compared to Dec 2017 PhP36.36/liter of diesel and PhP47.85/liter of gasoline.

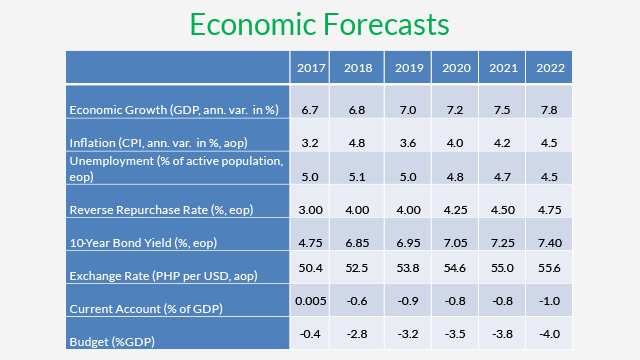

- Despite the decrease in auto sales, MotorVehicle Loans (MVLs) increased in first quarter of 2018 by 21%. MVL is composed of Auto Loans and Motorcycle Loans with 96.3% and 3.7% shares, respectively.

Future Projection: Prospects are bright for automotive sector

• However, auto sales are expected to recover due to growing OFW remittances and tampering effects of the tax reform.

• Consumer preference shifted towards cars that are known to safety (i.e. SUVs). To come up with more fuel-efficient cars, more crossover utility vehicles (CUVs) were introduced such as Toyota Rush, Mitsubushi Xpander and Honda BR-V.

Article by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its content.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion