Introducing Biz Starter: Checking account for MSMEs, exclusively for UnionBank GlobalLinker members

Finance & Accounting

322 week ago — 3 min read

As your business grows, having your own business checking account is necessary to manage your cash flow and expenses. A checking account gives legitimacy to your business and allows you to easily track expenses, receipts, payments, and other matters relating to the finances of your business.

But for MSMEs (micro, small, and medium enterprises), opening a business checking account can be challenging, especially since most banks in the Philippines offer a business account with minimum balance requirement ranging from Php 25, 000 – Php 100,000. This leads small business owners to use their personal account for business transactions which is not ideal for business growth.

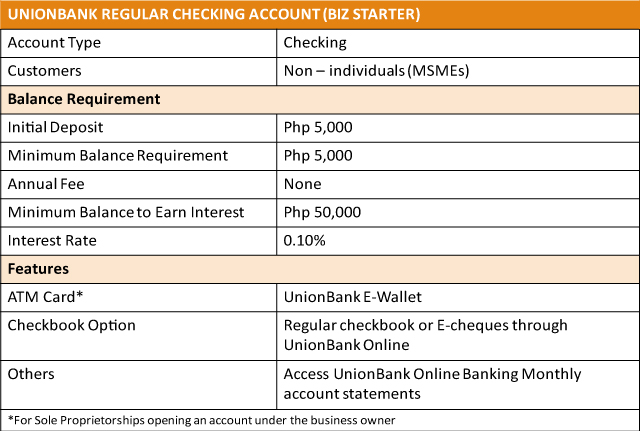

To help MSMEs overcome this challenge, UnionBank of the Philippines has introduced the ‘Biz Starter account’. This is a checking account with only Php 5,000 as an opening balance and minimum balance requirement for micro, small, and medium enterprise owners that can only be availed via UnionBank GlobalLinker! This means that it’s an exclusive offer for UnionBank GlobalLinker members only.

Apart from its low opening balance and minimum balance requirement, you will receive the following with your Biz Starter account:

- Checkbook

- Debit Card

- Access to online banking

- 24/7 account management through the UnionBank Corporate Facility

Reasons to get a Biz Starter account

- Access your working capital through checks, debit card (for sole proprietor only), and online banking

- Check your account balance anywhere through online banking

- Easily track your business transactions and expenses

- Manage your cash flow effectively

- Low opening balance and minimum balance requirement of only Php 5,000

How to open an account as a UnionBank GlobalLinker member

Go to the UnionBank GlobalLinker homepage and click the ‘Your Banking Needs’ button. On ‘Your Banking Needs’ page, click Savings and Checking Account where you will find the Biz Starter account offer.

Having your own business checking account will make it easier for you as a business owner to manage and monitor your business. What are you waiting for? Open your Biz Starter account now!

Click here to avail Biz Starter and get the exclusive offer for UnionBank GlobalLinker members.

Note: Those who already have an existing business account with UnionBank can no longer avail the Biz Starter account.

For inquiries and concerns, please contact our 24-Hour Customer Service at (+632) 841-8600 for Metro Manila; 1-800-1888-2277 for PLDT domestic toll-free calls; and (IAC) + 800-8277-2273 for international toll-free calls, or send us an email at customer.service@unionbankph.com. You may also visit the nearest UnionBank branch near you.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

Most read this week

Trending

Comments (12)

Share this content

Please login or Register to join the discussion