MktsFocUs: Trimming duration exposure

Economy

183 week ago — 8 min read

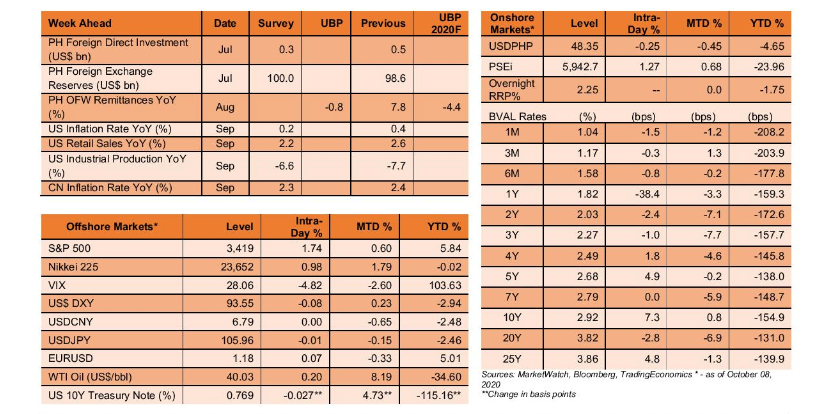

BVAL rates forecast ranges: 5yr 2.685% - 2.865% 10 yr: 2.922% - 3.012%

Pay short duration/Neutral on the curve’s belly/Receive long end on dips

Week ahead (Oct 12-16): Curbing duration exposure amid excess liquidity in the system as gleaned from recent auction results for government bonds and term deposit facilities, may sustain this week’s biddish sentiment. Shorter duration exposure can be attributed to sustained preference for liquid assets during the crisis period rather than higher inflation expectations. Until sellers’ volume recede, the buy-on-dips strategy may prevail.

Previous week’s recap (Oct 5-9): Local CPI print came out as expected prompting market participants to take profits resulting in yields up by an average of 2-3 bps. Ahead of the 3yr bond auction last Tuesday, pruning of bond positions prevailed. The auction generated strong market interest with a hefty bid-cover ratio of 3.8x. However, there was selling pressure on the curve’s belly particularly on the liquid RTB (5-13) as the market’s mood turned sour following the BTR’s announcement of a Php15bn tap facility after the auction. RTB’s yield drifted up to 2.65% during mid-week (previous session’s close: 2.615%). Preference to take profits/lighten up on RTB exposure persisted towards end-week. Limiting duration exposure seems to be an emerging theme.

USDPHP forecast range: 48.30 – 48.60

Tactical sell USD/Long-term underweight PHP

Week ahead: The range of 48.30-60 is expected this week with support from data releases on the Aug PH trade balance (survey: -US$2bn/UBP:-US$1.5bn) and Aug OFW remittances (UBP:-0.8%YoY). A monthly trade shortfall of US$2bn or less due to slumping imports with fading export weakness, would ease any pressure on USDPHP from lacklustre remittances. As US markets appear to be more at ease with a ‘blue wave’ dominating next month’s US elections, raising likelihood of more fiscal stimulus post-elections, a weak USD backdrop may be here to stay.

Previous week’s recap: USDPHP consolidated in a tight range of 48.35-45. Before start of the week, USD rallied briefly as risk-off prevailed on last Friday’s (10/2) news of US President Trump testing positive for COVID-19. Risk-on resumed accompanied by weak USD as Trump decided to return to the White House after a 2-day hospital stay. Equally important is the political consensus building up for the US Congress to pass a fiscal stimulus package. While Trump rejected further negotiations on a total package, he proposed piecemeal income relief/support for airline workers and others. USDPHP went through shallow adjustments despite a plethora of unfavourable newsflow including escalation of case infections in the US and Europe

PSEi Forecast range: 5,800 – 6,000

Accumulate the index

Week ahead: The index will continue to trade within the narrow range of 5,800 – 6,000. Market looks ripe for profit-taking as PSEi edges closer to 6,000. The lack of interest in big cap names is likely to persist among retail investors. This local bias for non-index stocks was a reaction to foreign selling overhand in the market. Until foreign net outflows dissipate, PSEi’s strong market resistance seems to be at 6,000. PSEi may look to offshore news and developments for catalysts this week.

Previous week’s recap: PSEi jumped 1.27% (74.78 pts) intra-day in Thursday’s session, breaking a three-day slump and wiping out losses from the previous two sessions with bargain hunters buying the index up. Exiting foreign funds persisted as net outflows accelerated week-on-week amid unexciting PH recovery prospects and likelihood of delayed approval of the 2021 PH budget program.

Article by: Ruben Carlo Asuncion

Contribution from Bank Treasury, Trust & Investments and Corporate Planning Groups

Image Source: Freepik

No Warranties and No Liability

Basic information used in Market Narratives and MktsFocUs and other market/economic commentaries by senior staff of Union Bank of the Philippines (“UBP”) were sourced from news articles of several foreign and local broadsheets and news and market-based websites. As such, its contents are not owned by nor have been written or prepared by UBP. UBP does not own any of the contents of the Narratives, MktsFocUs and others and as such does not have any right to grant any rights to recipients. The terms and conditions of your use of the contents of the Narratives are governed by the rights granted and restrictions imposed by the source and/or owner of the contents and the same are subject to all applicable international and local laws and regulations.

Although the contents have been obtained from sources believed to be reliable, they are provided to you as presented, without any recommendations or warranties of any kind from UBP. UBP, its officers, directors, employees and agents cannot and do not make any representations and disclaim all warranties, express or implied, in respect of the Narratives and MktsFocUs and its contents, including, but not limited to, guarantees, representations and warranties regarding truth, adequacy, reasonableness, accuracy, timeliness, completeness, non-infringement, merchantability, satisfactory quality, or fitness for any particular purpose, or any representations or warranties arising from usage, custom or trade by operation of law. UBP, its, officers, directors, employees and agents assume no responsibility for the consequences of any errors, inaccuracies or omissions in the Narratives and MktsFocUs and other market-related publications.

Any opinion or statement in the Narratives, MktsFocUs, and other market publications does not constitute the opinion of UBP. Your use of the Narratives, MktFocUs and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on these market commentaries/research products.

The Narratives and MktsFocUs and related market commentaries are provided to you as a free service and on an “as is or as available” basis. As such, UBP does not guarantee the distribution of these research-based products will be regular, timely or uninterrupted. UBP, its officers, directors, employees and agents do not assume any responsibility for consequences of any non-delivery or non-provision, errors, delays, omissions, interruption, breach of security or corruption in connection with these market/research products, notwithstanding any prior advice of such possibilities.

UBP likewise does not guarantee, represent or warrant that the Narratives and MktsFocUs or any of its contents, including but not limited to links found in the contents, are free of malicious software, including, but not limited to, viruses, computer worms, spyware or other harmful components ("Malicious Software"). UBP, its officers, directors, employees, and agents do not accept any liability for any loss, damage, claim, liability, expense or costs arising or that may result from any transmission of such Malicious Software through these market /research products including, but not limited to files downloaded from the Narratives and MktsFocUs or from the compiling, interpreting, editing, reporting or delivering these bank research products.

In no event shall UBP be liable to you or to anyone else for any claim arising out of or relating to the Narratives and MktsFocUs, including but not limited to direct, consequential, special, incidental, punitive or indirect damages, even if advised of the possibility of such damages. UnionBank of the Philippines is supervised by the Bangko Sentral ng Pilipinas.

For concerns, you can contact us at (02) 841-8600 or customer.service@unionbankph.com or the BSP Financial Consumer Protection Department at (02) 708-7087 or consumeraffairs@bsp.gov.ph

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

View UnionBank 's profile

Most read this week

Trending

How this sister duo got greater business exposure and sales with an online store

Ecommerce 157 week ago

5 Must-Have Emails for Your Online Store

Ecommerce 34 week ago

Comments

Please login or Register to join the discussion