Philippine Economic Outlook: Strong Manufacturing and Robust Domestic Demand Buoy Growth

Economy

288 week ago — 3 min read

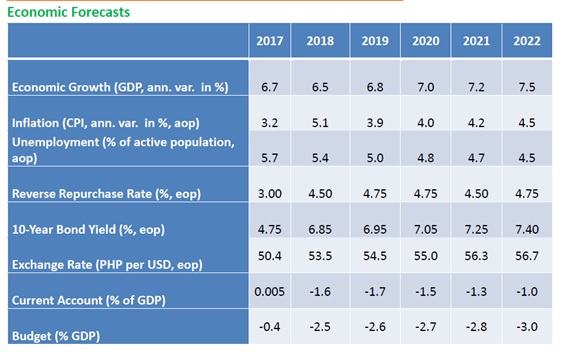

The Philippines remained as one of the best-performing economies in Asia despite a softer gross domestic product (GDP) at 6.0% in Q2 2018. The economy is still expected to achieve a full year growth of 6.5% (Chart 1).

For September, Philippine manufacturing activity remained strong, beating the regional average of 50.5 at 52.0 on the ASEAN’s Manufacturing Purchasing Managers’ index. The robust domestic demand has consequently driven the rise in fresh orders, offsetting persistent inflation and soft foreign demand.

Meanwhile, September inflation is expected to be at 6.9% higher than 6.4% in August (Chart 2). The main drivers of September inflation rice are the Food and non-alcoholic price, housing, water, electricity, gas, and other fuels, and transport.

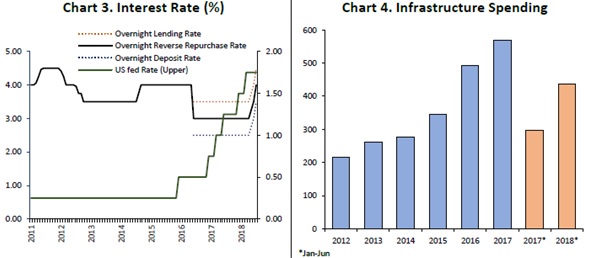

To curb the rising inflation expectations, the Bangko Sentral ng Pilipinas (BSP) raised another 50 bps points in its borrowing rate to 4.5%. Even after raising a total of 150 bps this year, the hawkish cycle of the BSP inflation-targeting may persist due to consumer price pressures. (Chart 3).

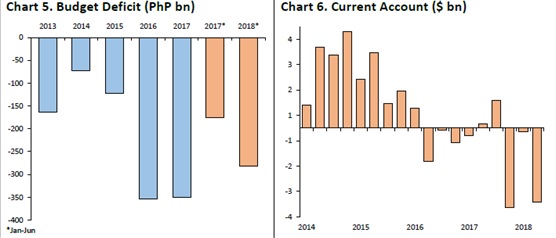

Government spending on infrastructure grew as much as 47%, year-on-year from January to July, according to the Department of Budget and Management (DBM). Spending on infrastructure development reached PhP437.2 billion up from PhP297.5 billion in the same period last year. The drivers are infrastructure and part of it is also the acquisition of military hardware.

The National Government posted a budget deficit of PhP282 billion from January to August 2018. This is higher than the PhP176.2 billion in the same period last year as the growth in expenditures once again outpaced the increase in revenues (Chart 5).

The current account (CA) gap swelled to $32.9 billion in the second quarter of 2018 compared to $157 million recorded in the same period last year. This is increasingly weighing on the Philippine peso through capital inflows and a hawkish central bank. (Chart 6).

Looking ahead, we expect softer 2018 growth than current government targets with tighter monetary policy and an elevated inflation to persist for the rest of 2018. Despite these, the overall health of the macroeconomy is still robust. H2 GDP is expected to be stronger than H1.

Outlook by Ruben Carlo O. Asuncion, UnionBank's Chief Economist

Note: Any opinion or statement in the Philippine Outlook does not constitute the opinion of UBP. Your use of this document and any of its contents is at your own risk and UBP does not accept any liability for the results of any action or decision taken on the basis of or reliance on the Philippine Outlook or any of its content.

Posted by

UnionBank PublicationWe are a team of professionals providing relevant content to startups, micro, small and medium enterprises.

Network with SMEs mentioned in this article

View UnionBank 's profile

Most read this week

Trending

UnionBank GlobalLinker Linker.store Contest

Ecommerce 115 week ago

Comments (3)

Please login or Register to join the discussion